FreeAgent vs QuickBooks: A comparison for SMBs

Produced by our content partners and reviewed by Envoice’s internal experts to ensure it reflects real accounting workflows and accurate product usage.

Running your business is tough enough without worrying about accounting headaches. But then again, finding the right software that provides a balance between simplicity, scalability, compliance, and cost can create a different kind of headache.

With the accounting software market projected to grow to $39 billion by 2029 [1], the competition is fierce, and selecting the right accounting software to meet all your business needs can be daunting. We explore two leading tools, FreeAgent and QuickBooks, and help you decide which one could help you run things smoothly.

At a Glance

- FreeAgent gives SMBs one all-inclusive plan with essential features for business growth.

- QuickBooks requires scaling up through multiple tiers to unlock the same features, making it pricier over time.

Table of Contents

- FreeAgent vs QuickBooks: Offering for SMBs

- FreeAgent vs QuickBooks: Key features overview

- FreeAgent vs QuickBooks: Detailed comparison

- Conclusion

- Frequently Asked Questions

FreeAgent vs QuickBooks: Offering for SMBs

One of the biggest differences between FreeAgent and QuickBooks is how they structure their offering. QuickBooks takes a tiered approach (get what you need now, and scale later), while FreeAgent offers one all-inclusive plan.

FreeAgent: All-inclusive plan

Targeting small businesses, freelancers, contractors, accountants, and landlords, this UK-focused tool with tax-filing automation gives unlimited users open access to all its features at a flat monthly fee. Certain bank account holders in the UK can use the platform for free.

QuickBooks: Tiered growth

QuickBooks offers four main subscriptions, each one unlocking more advanced features.

- Simple Start: Designed for solopreneurs or early-stage businesses, it caters to a single user and focuses on basic accounting functions.

- Essential: Best for growing businesses that have begun to manage contractors and payroll for multiple staff. It caters to three users.

- Additionally, it unlocks robust reporting capabilities, budgeting, and inventory tracking. Add up to five users. This is a popular plan with growing SMBs.

- Advanced: Scales up to twenty-five users with custom report building, manages budgets, and workflow automation.

💡Cost-saving idea: Get advanced features like data extraction and workflow automation without the high cost. How? By adding Envoice to QB Simple Start for $14 a month. Sign up for an Envoice free trial and watch it get to work.

FreeAgent vs QuickBooks: Key features overview

| Feature | FreeAgent | QuickBooks |

| Automate accounting tasks | Limited | Yes |

| Create invoices | Yes | Yes |

| Recurring invoices | Yes | Essentials+ |

| Expense tracking | Yes | Yes |

| Receipt capture with mobile | 10 receipts/bills per month

$5 extra for unlimited capture |

Yes |

| Bill management | Yes | Yes |

| Tax management | Yes + file directly to HMRC | Yes |

| Automatic bank feeds | Yes | Yes |

| Auto-generated bills and payments | Yes | Yes |

| Mileage tracking | Yes | Yes |

| Estimates | Yes | Yes |

| Tracking billable hours | Yes | Essentials+ |

| Customer management | Yes | Yes |

| Online payments | Yes | Yes |

| Payroll management | Yes | Additional module |

| Project management tools | Yes | Plus+ |

| Track inventory | Yes | Plus+ (full inventory management) |

| Mobile app | Yes | Yes |

| Third-party apps | Limited | Extensive |

| Pricing | £33 – Limited Company

£27 – Partnership £19 – Sole trader £10 – Landlord |

$38 – Simple Start

$75 – Essentials $115 – Plus $275 – Advanced |

FreeAgent vs QuickBooks: Detailed comparison

Finding the best accounting software for your business isn’t just about ticking off features. It requires a more detailed understanding of how the tools will improve your business processes and help you run them better. Here we discuss the finer details of the software features.

FreeAgent: Essential features

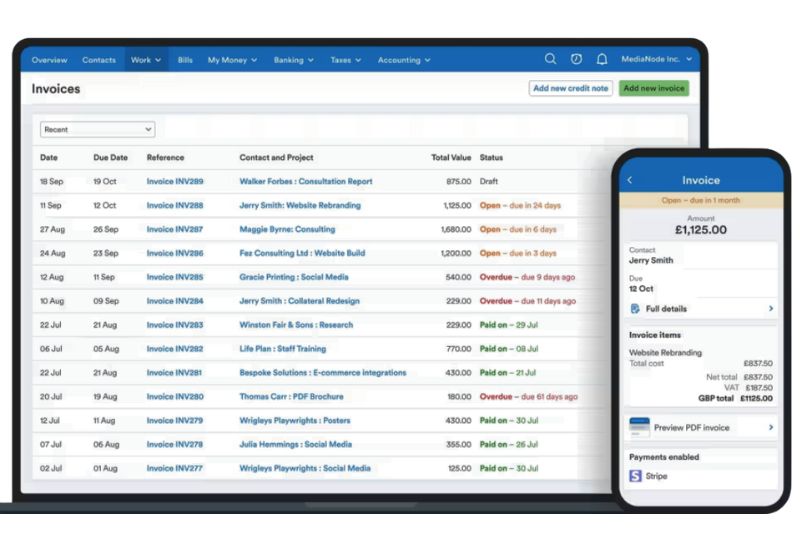

1. Invoicing

FreeAgent

Any accounting software that helps your business grow steadily will include a robust invoicing function and provide a real-time view of whether you’re being paid or not. With FreeAgent, you can:

- Create a new invoice directly from an estimate or using existing customer details.

- Create a PDF and email the invoice to your customers.

- Insert a payment link to get paid faster with Tyl, Stripe, PayPal, or GoCardless.

- Set automatic payment reminders.

- Invoice on the go with the FreeAgent mobile app, and benefit from real-time invoice information while you’re away.

- UK tax compliance for freelancers and small companies that are based in the United Kingdom.

- Flag recurring invoices so they’ll send automatically.

- Invoice in a variety of currencies and languages with advanced invoicing features.

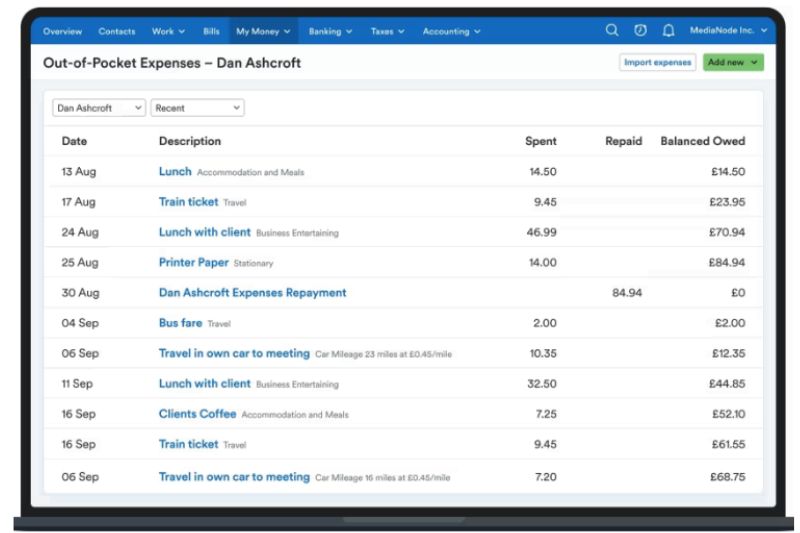

2. Expense tracking

FreeAgent

FreeAgent simplifies expense tracking, and unlike other accounting platforms, it doesn’t charge extra for this feature. Their expense management features work like this:

- Capture all receipts and bills with the mobile app for automated processing and categorization.

- Track bank payments and out-of-pocket expenses via the ‘my money’ dashboard.

- Set recurring expenses and never forget supplier payments.

- Keep track of all employee expenses and reimbursements.

- Keep accurate records with customizable expense categories.

- Log mileage expenses quickly with the mobile app (HMRC rates loaded for UK customers).

3. Banking

With FreeAgent you can set up a bank feed, link all your bank accounts, and let multiple transactions flow into one FreeAgent account.

While you’re concentrating on other things, Smart Capture automatically categorizes and sorts out your transactions. This improves the accuracy of your tax return submissions. Furthermore, you’ll always know if you have a healthy cash flow because ‘Cashflow Forecast’ will help you see 90 days into the future.

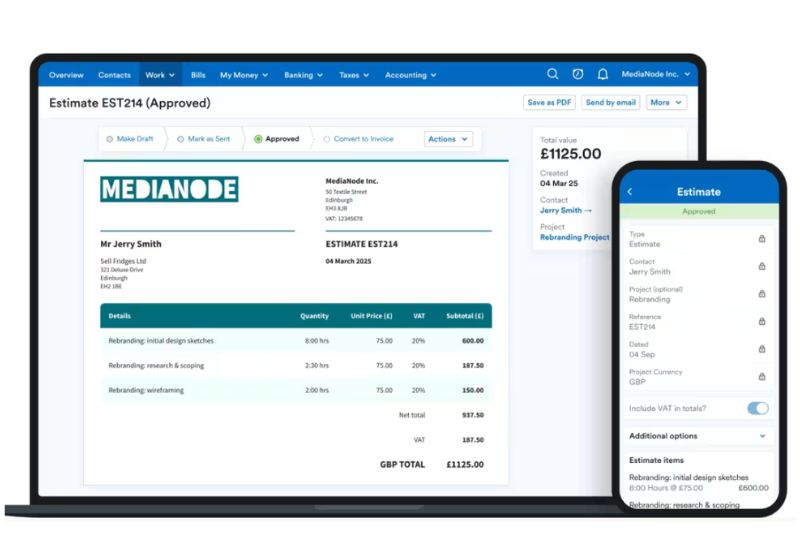

4. Estimates

FreeAgent

When you’re trying to win your next customer, a quick response counts. Stand out from the competition by:

- Creating an estimate in minutes with customizable templates.

- Generating online estimates in multiple currencies and languages.

- Converting estimates into invoices in seconds with a single click.

- Combining multiple estimates into one invoice.

- Including discounts so your customers can see the value they’re getting.

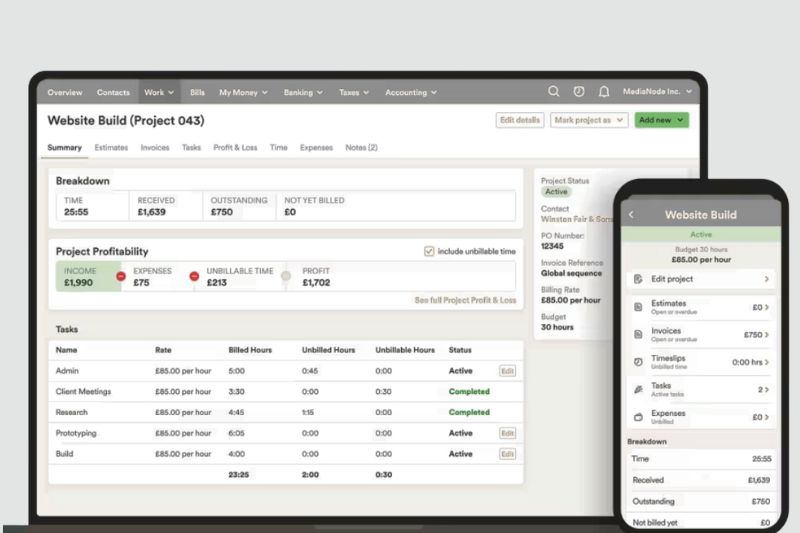

5. Project management and time tracking

FreeAgent

Trying to manage all the moving parts of a complex project manually can turn into a nightmare. With FreeAgent, you no longer need to keep track of project expenses on a spreadsheet. Instead, try this:

- Create a project within FreeAgent.

- Build to-do lists to keep the project on track.

- Track your time on each task against the proposed budget.

- Keep an eye on unbilled time, estimates, and expenses—all in one place —and then invoice with a single click.

- Report on successes or challenges with project-level profit and loss statements.

QuickBooks: Essential features

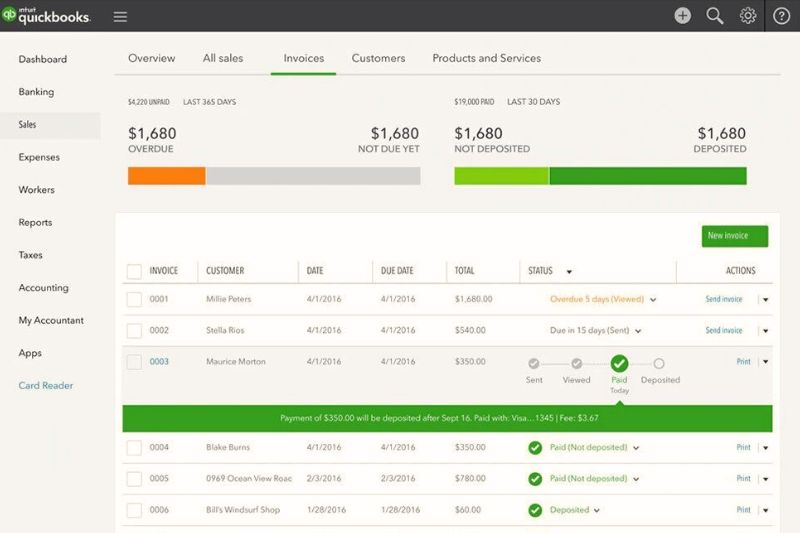

1. Invoicing

Intuit QuickBooks

SMBs can create invoices in QuickBooks in just a few easy steps, helping you quickly increase your business finances. Create single invoices or do batch invoicing for more complex financial transactions with QuickBooks Advanced. SMBs will love these invoice features:

- Create and send custom branded invoices.

- Create and send invoices using the QB mobile app.

- Add a ‘pay now’ button to all invoices for faster payments with debit and credit cards, PayPal, Apple Pay, and Venmo.

- Set up recurring invoices for regular customers to be sent at specific times.

- Automatic calculations of sales tax, discounts, and shipping fees.

- Multi-currency and multi-language invoices on higher plans (Essentials, Plus, and Advanced)

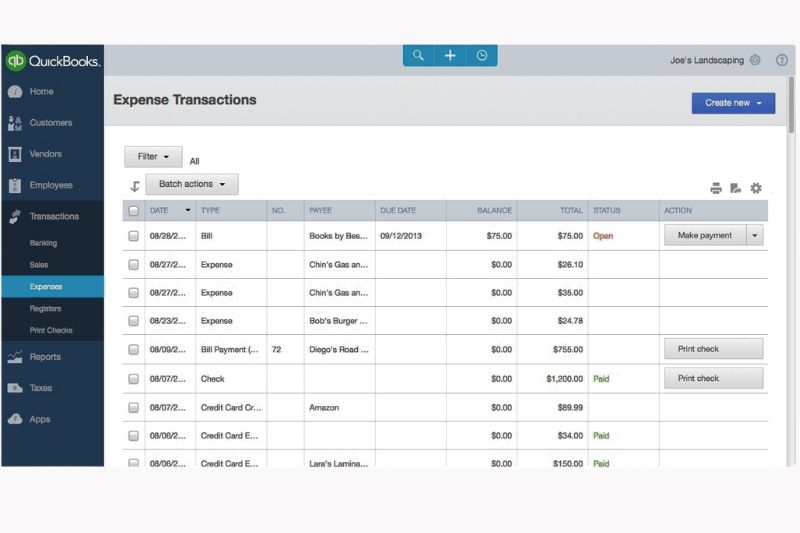

2. Expense tracking

Intuit QuickBooks

QuickBooks helps you ensure strict financial management with a robust expense tracking feature. The user-friendly interface enables you to view and manage expenses easily, as well as create detailed reports. Even with the basic features, you can:

- Snap photos of your receipts and bills, which are then uploaded and stored securely.

- Benefit from expense categorization, according to either the standard chart of accounts or customized accounts.

- Automatically track business mileage with QB’s mobile app – the GPS logs the mileage, and you review and approve.

- Advanced reporting, drilling down into different expense types.

📗Get further insight: How to Organize Receipts for Small Business Using Automation

3. Banking

Connect all your bank accounts and credit cards to QuickBooks in a few easy steps. The software will securely and automatically import bank transactions and initiate bank reconciliations by matching transactions. The platform also helps you manage your cash flow with real-time and comprehensive views of your bank accounts and cash flow.

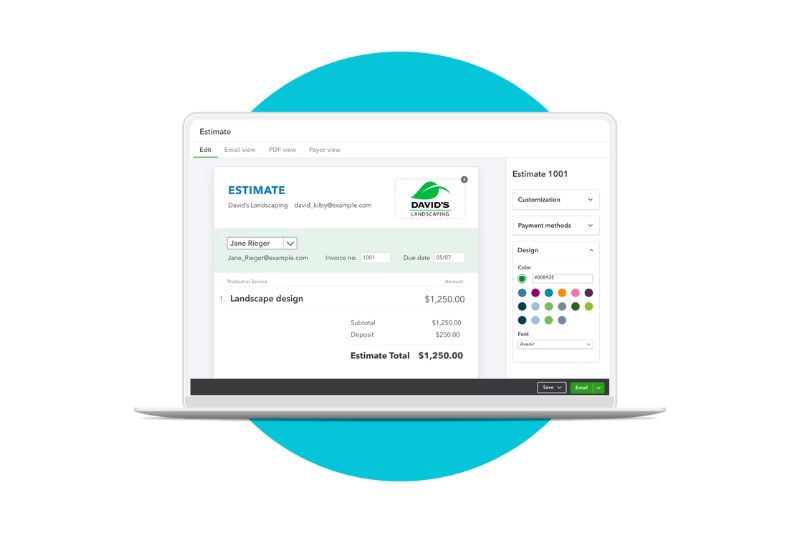

4. Estimates

Intuit QuickBooks

For SMBs competing against larger companies, providing quick and accurate estimates is crucial for winning business. When estimates are time sensitive, use QB to do the following:

- Create professional estimates with detailed line items for products, services, and materials.

- Track the real-time status of your estimates, including ‘pending’, ‘accepted’, or ‘rejected’.

- Request upfront deposits on estimates using QuickBooks payments. This ensures adequate cash flow for projects.

- Convert estimates to invoices with one click.

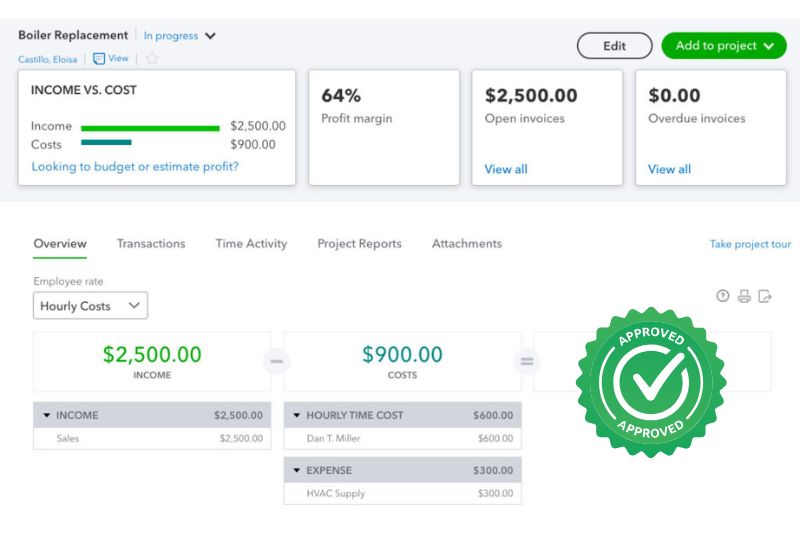

5. Project management and time tracking

Intuit QuickBooks

With QuickBooks, project tracking and project profitability are only available on higher plans, such as Plus and Advanced, while time tracking is available on Essentials. QBO will help you manage projects as follows:

- Get a real-time overview of all the costs incurred to help you gauge profitability.

- All estimates, invoices, expenses, and time cards associated with the project are grouped together.

- QB’s management reports help you drill down into project details and report successes or constraints.

- Track time from various devices, making it easy for project timelines to be reported.

- Seamless integration with payroll and invoicing.

📗Get further insight: How To Choose The Right Accounting Software For Your Business

Conclusion

Both platforms offer powerful features, but SMBs must upgrade to higher QuickBooks plans to unlock the full suite. In summary:

- Freelancers, SBOs, and contractors: Choose FreeAgent for its all-in-one offering.

- Service-focused SMBs: Choose QuickBooks Essentials or Plus.

- Growing SMBs with inventory: Choose QuickBooks Plus or Advanced.

💡 Pro tip: Skip overspending on higher tiers for automation. Pair QB Simple Start with Envoice to get advanced data capture, approvals, and workflow automation for just $14/month. Start your free trial and see how quickly Envoice pays for itself.

Frequently Asked Questions

1. Do I need extensive accounting knowledge to use FreeAgent or QuickBooks?

Not at all. Both tools are designed for business owners without an accounting background. That said, QuickBooks has a steeper learning curve, while FreeAgent is more intuitive for beginners.

2. Can I make international payments using FreeAgent or QuickBooks?

No, neither platform supports international vendor payments directly. To handle cross-border payments, you’ll need to integrate a third-party service like Wise Business.

3. Which software is best if I plan to scale quickly?

If you’re aiming for rapid growth or managing teams of more than 10, QuickBooks Advanced offers scalability and customization. FreeAgent is best suited for freelancers and smaller SMBs that value simplicity over advanced customization.

4. Can I migrate from FreeAgent to QuickBooks (or vice versa)?

Yes, both platforms support data export and import; however, certain elements, such as bank feeds and historical reconciliations, may need to be set up manually or with third-party migration tools.

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day