Xero vs Sage: Which one is a better fit for SMEs?

Every day, more and more businesses across the globe are offered choices in cloud-based accounting software. These choices often reflect best-in-class applications that promise to make financial management easier, simpler, and faster for SMEs. But how do you, as a business owner, choose the best fit for your business and confidently stick with one platform?

We examine two popular accounting software choices for SMEs, Xero and Sage. By comparing key features, we bring you an increased perspective, helping you to choose wisely between these powerful accounting tools.

Quick Overview

Xero vs Sage is a comprehensive look at competing accounting software. Xero is a cloud-based, user-friendly system with strong integration with third-party apps. This makes it a firm favorite among small businesses. Sage brings advanced features such as inventory management, predictive analytics, and Salesforce integration, making it suitable for medium-sized companies.

Table of Contents

- Compare the main features of Xero vs Sage

- Xero

- Sage

- Conclusion: Which software will suit your SME?

- FAQs: Xero vs Sage

Compare the main features of Xero vs Sage

| Feature | Xero | Sage 50 Accounting |

| Ease of use/onboarding | Very strong, cloud-first design | Strong, but higher complexity in some modules |

| Bank feeds & automatic reconciliation | Excellent support, many banks, good automation | Very good, especially in mature markets, but may require more setup |

| Invoicing, quotes & expense tracking | Strong, good for SMEs handling volumes and automation | Also strong, unlimited invoices in many plans |

| Multi-currency / international transactions | Good support in higher tiers | Advanced support, especially in larger business modules |

| Integrations & ecosystem | Very large app marketplace, flexible | Good, but more structured and sometimes less “plug-and-play” for smaller firms |

| Reporting, dashboards & analytics | Strong for SME reporting needs | More advanced reporting, suited to more complex or layered businesses |

| Automation & workflow support | Excellent for streamlining manual tasks, ideal for focusing on growth | Good, especially for more complex process flows, multi-entity operations |

Xero

Ease of use/onboarding

For most SMEs, a lengthy onboarding process combined with hard-to-use software just isn’t feasible. Luckily, Xero is built on a cloud-based architecture and has a clean interface, making its adoption easy. It is optimized for users who are not full-time accountants and need guidance through the setup process.

Bank feeds and reconciliation

Xero users report saving 5.5 hours a week with bank feeds and automated transaction matching. [1] This ensures faster bank reconciliation and up-to-date financial management, with 21,000 institutions worldwide able to feed financial data into Xero. Import PDF bank statements to retrieve relevant financial information in the absence of bank feeds.

Invoicing, quotes, and expense management

With Xero, you can create, customize, send, and track your invoices online. Automate reminders and give your customers an online payment link to speed up payments. Project tracking enables automated time and expense tracking, quote sending, and invoice generation from quotes. You’ll see where your money is going in real time, making cash flow management easier.

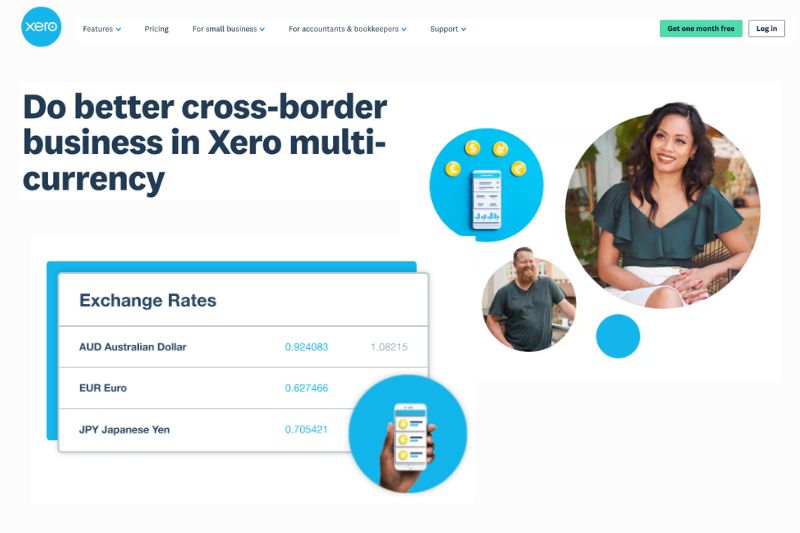

Multi-currency and international use

Do business in multiple currencies with real-time foreign exchange rates, and simplified payments and collections. View reports in local or foreign currency to see how your international business is doing. Xero helps you comply with international accounting standards in over 160 countries.

Integrations and a unique ecosystem

Xero’s key strength is its large app marketplace. Hundreds of integrations across e-commerce, payroll, and CRM are available, enabling SMEs to customize the platform for multiple businesses. This is a huge opportunity to build a lean stack with the best-in-market tech and avoid being locked into one vendor.

Reporting and analytics

Xero reporting includes standard reports for managing business finances (P&L, Balance Sheet, Cash Flow Statement), and powerful dashboards geared towards the small business owner. Its power in reporting lies in it being a cloud-based accounting software where large amounts of data can be pulled together quickly, and in the format you need.

Automation and workflow support

Because Xero is so well integrated, the opportunities for automation and workflow approval are endless. For SMEs that need to scale without increasing headcount, third-party app integrations offer automated bank reconciliation, manual data entry, customized invoices, and faster business decisions at an affordable price.

⚙️ Get a deeper insight into automation: 5 Advanced Benefits of Automated Invoice Processing

Automation in practice

When third-party integration, Envoice and Xero join forces, you’re about to double your automation and workflow approval capability. Xero users can collect bills and reduce human errors significantly with intelligent data capture. Your pre-accounting work reduces, and your overheads don’t increase – that’s the main benefit.

With workflow approvals, employees submit expense reports, and reimbursement is one step away. No more bottlenecks, delayed payments, and wondering where tasks are sitting in the workflow. Just a smooth transition through your business processes.

Ready to integrate Xero and Envoice?

Sage 50 Accounting

Ease of use/onboarding

Sage is known as one of the best accounting software programs, and while it is also cloud-based, it offers the depth of a system designed for more complex businesses than Xero. This may mean more upfront training and investment in configuration, but the payoff will be greater control and adaptability as the company grows.

Bank feeds and reconciliation

Sage offers users automatic bank feeds and reconciliation capabilities. This provides the ability to pull bank transactions on a regular basis, and reconcile these transactions.

This is a huge and time-consuming task, whether you’re a smaller business or a medium-sized business. To further speed up the process, you can create custom rules to deal with recurring transactions.

Invoicing, quotes, and expense tracking

For businesses with sales across multiple product lines and departments, Sage offers deeper control over invoicing and quotes. Easily view where revenue and expenses are coming from and use data-focused analytics to predict future cash flow.

Get an instant business snapshot of transactions and send payment reminders to accelerate cash collection.

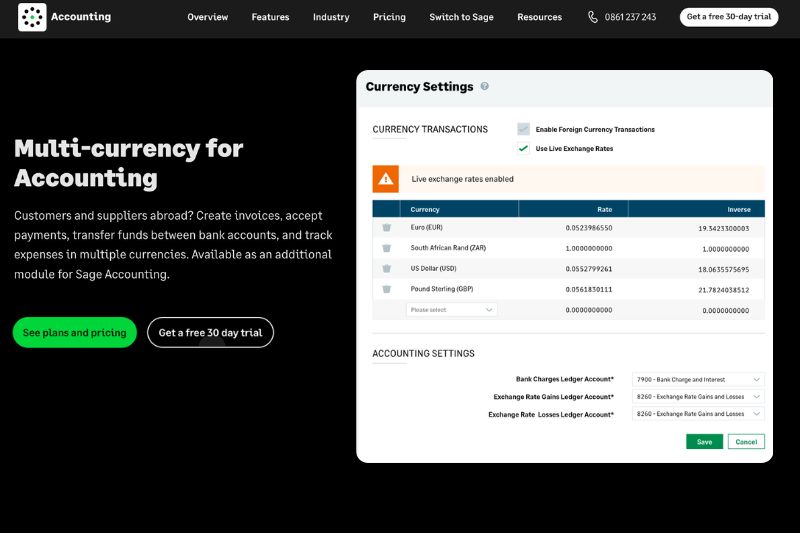

Multi-currency and international use

This is an area in which Sage stands out. If your business operates internationally and holds inventory in multiple countries, Sage offers advanced features to manage your exchange challenges.

Choose your currency with just one click from a drop-down list covering over 200 countries. From here, you can add bank accounts and track financial transactions using the right currency for every project, job, or service. Turn on live exchange rate mode for up-to-date information, and keep track of losses and gains through comprehensive reporting.

Integrations and a unique ecosystem

Sage also integrates with a wide variety of third-party integrations, but how they approach it differs from Xero. Sage expansion is primarily delivered through additional modules that add payroll, inventory, and project management functionality.

This approach can benefit businesses that enjoy premium accounting pricing models, keeping their operations tightly integrated with Sage.

Reporting and analytics

Sage provides users with over 150 reports, including industry-specific solutions, such as manufacturing, construction, or professional services. [2] Drill down into projects, departments, products, and teams while forecasting performance based on live data.

Automation and workflow support

Sage automation excels at structured workflows. Automate processes with customized rules and approvals, and allocate user rights and levels. However, beginners should know that it will take more time than with Xero to get these workflows working seamlessly.

⚙️ Get a deeper insight into automation: AP Automation & Machine Learning: Finance Game Changers

Conclusion: Which software will suit your SME?

Deciding on the right accounting software isn’t always clear-cut – there are many nuances that need to be considered. However, if you want the short answer, it’s as follows:

- Choose Xero if: You’re a smaller business that wants easy setup, a user-friendly interface, and the ability to use powerful accounting features. Xero packs a whole host of these features into its cloud-based software.

- Choose Sage if: You’re looking forward and know you’ll need more complex accounting functions later, like multi-entity structures, and highly complex reporting.

Whatever the software you pick, the upstream processes matter: accurate invoice capture, clean expense processing, minimal manual data entry and real-time visibility. Envoice integrates with both Xero and Sage, bringing powerful automation and workflow approval functionality to these systems.

FAQs: Xero vs Sage

1. Can Xero and Sage both handle unlimited users?

Both Xero and Sage Accounting can handle unlimited users thanks to their cloud-based architecture. However, they hold the terms of their subscriptions differently. Xero offers unlimited users on all its plans, while Sage limits it to 40 users on higher-tier subscriptions.

2. Is Xero or Sage better for multi-currency transactions?

Both offer some form of multi-currency support. Xero only supports it on its top subscription (Established), while Sage offers advanced multi-currency transactions covering the complexities of growing businesses.

3. How easy is it to integrate automation and workflow approvals in Xero and Sage?

Xero is more of a plug-and-play accounting system thanks to its large marketplace and APIs. This makes it perfect for SMEs to mix-and-match integrations, creating a customized accounting platform. Sage offers automation and workflow approval for higher-priced subscriptions, reserving this functionality for larger companies. For advanced automation and workflow approval, an app like Envoice can be integrated with both accounting tools.

4. If I start with Xero and then grow, can I migrate to Sage?

In many cases, yes. However, migrating systems becomes increasingly difficult once you’ve familiarized yourself with the features and adapted your processes. Data export/import, code mapping, historical transactions, and attachments must be carefully handled to prevent data inconsistencies.

External References

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day