Expensify vs QuickBooks Online: Which is Best for Your Business in 2025?

Running a small business means you have to run a tight ship. Balancing your income and expenses is a vital part of managing your cash flow, and any waste can cost you much needed profits. You need financial management tools you can rely on for quick and efficient bookkeeping and accurate taxes.

This guide compares Expensify and QuickBooks, two popular expense management software programs. Join us as we cover their key features, pricing and usability for small businesses. We’ll also discuss how you can decide which platform will be best for your particular industry and business type.

Read on to learn more.

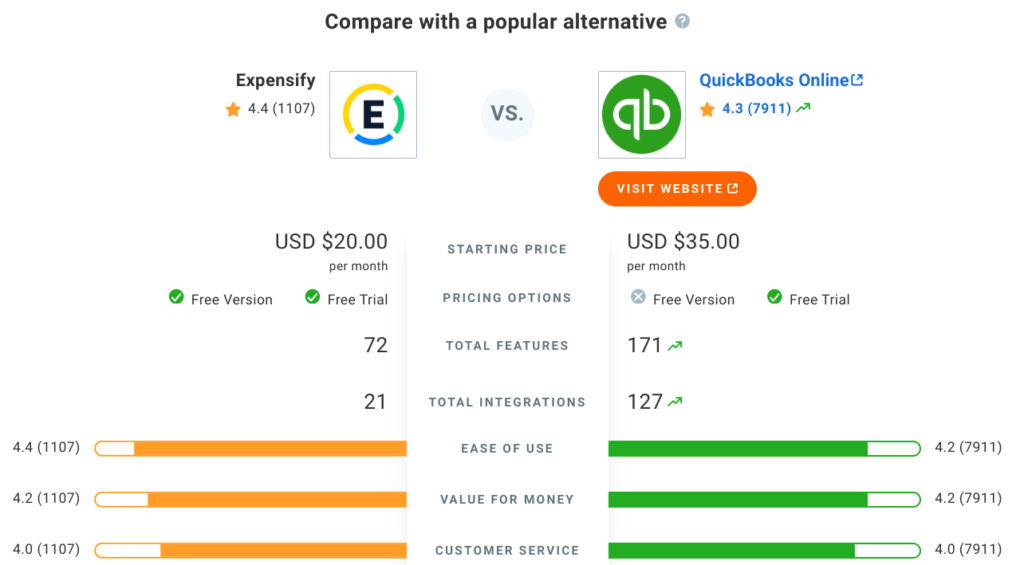

Expensify vs QuickBooks Online: Side-by-Side Comparison

| Expensify | QuickBooks | |

|---|---|---|

| Pricing | Starts at $20/month | Starts at $35/month |

| Features |

|

|

| Integrations | Over 21 apps | Over 127 apps |

| Security | SSL data encryption | QuickBooks Data Security |

| Cloud storage | Yes | Yes |

| Interface | SaaS/Cloud/Mobile | Saas/Cloud/Mobile |

| Customer Support | Email and live chat | Email and live chat |

| Reviews | 4.4/5 [1] | 4.5/5 [2] |

Expensify Features Breakdown

Expensify is a robust expense tracking software for small and medium-sized businesses. It focuses on automating expense management tasks like receipt capture, reimbursement management, and approval workflows. It has tools for expense management and report creation, helping you track all your business expenses and maximize your savings.

Invoicing

Expensify has excellent customizable invoice templates you can send for payment via Stripe. Its auto-import feature automatically collects and inputs invoice data based on your pricing and the services provided. The platform can also calculate fees, such as taxes and discounts. Once you send an invoice, a chat is created between you and your customer to answer any questions. No more switching between email, text, and apps.

This feature allows your business to issue invoices quickly and get paid directly. Faster payment means more cash in the bank for running day-to-day operations.

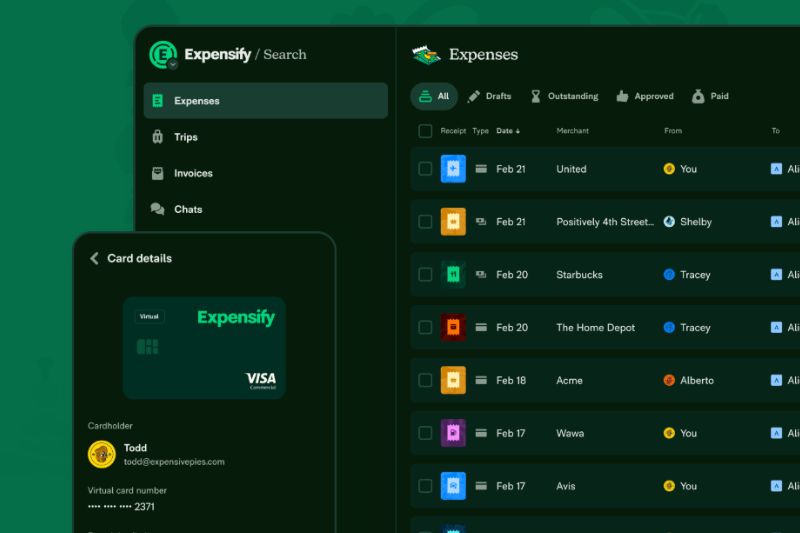

Expense Management

Expensify is a premier expense management software that allows you to track employee expenses and process reimbursements faster. It has robust reconciliation features that allow you to review unsubmitted expenses and compare statement amounts. Employees can submit receipts of their billable expenses through SmartScan.

Financial Reporting

Expensify allows you to create customized reports to see how much your company spends on various categories, providing you with spending and expense data for financial planning.

The platform can show real-time insights into your business’s spending trends for budget forecasting. Expensify supports over 20 reports, including aged approval reports, category spend reports, and mileage reports.

Expensify Additional Features

Spend Management

Besides effectively managing expenses, Expensify has corporate credit card management tools, such as the Expensify Visa Commercial Card. You can make payments directly on the platform via Bill Pay and create customized spending reports based on employee expenses to track cash flow. It also simplifies credit card reconciliation by importing all card expenses on the software.

Receipt Scanning

Expensify’s dedicated mobile application includes SmartScan, one of its receipt scanning features. Using optical character recognition (OCR), it can identify the receipt’s merchant, amount, currency, and date of purchase. Upon submitting a receipt, the app creates an expense report, allowing your employees to process and claim reimbursement immediately.

Note: Expensify doesn’t support automatic receipt data sorting into specific categories. If you want a more robust expense management solution, consider an add-on like Envoice. It uses receipt scanning technologies, like Human-in-the-loop review and corrections with ExactExtract if needed for 99.9% accuracy. Register for a free trial today.

Global Reimbursements

If you have employees overseas, you can use Expensify’s global reimbursement feature. It simplifies employee reimbursement through seamless cross-border payments, allowing them to receive the amount in their local currency. The software supports withdrawals from 24 countries with bank accounts in major currencies (USD, AUD, CAD, GBP, and EUR) and deposits to over 195 countries globally.

Integrations

Expensify supports integrations with different types of software, including ERP, accounting and finance, HR, tax compliance, and practice management. The platform supports apps like QuickBooks, Oracle NetSuite, Xero, Sage, Taxback International, Revel Systems, ANZ, etc. It also integrates with Tripcatcher and TravelPerk to manage travel expenses.

Ease of Use

Expensify has an intuitive and feature-packed interface. Its Inbox dashboard has a Concierge bot that helps you set up data needed for the expense management process, like bank reconciliation, receipt scanning, approvals, and more. The Expenses dashboard allows you to manage expenses efficiently and create automated reports. It also supports auto-sync, which automatically imports transactions and data to other accounting software.

Expensify Expenses dashboard

Pricing

Expensify has the following pricing plans per user: Collect ($5 per month) and Control ($9 per month). Both plans include receipt scanning tools, corporate credit card feeds, invoicing, and more. The platform also offers a free account, which lets you access the Expensify Card, limited expense tracking features, and up to 25 SmartScan monthly credits.

Note: While Expensify may seem cheap, they charge per user on both plans. If you want an expense management tool where you can add your team while keeping company data secure, try Envoice. It lets you add multiple user accounts at no additional cost. Sign up now for a free trial.

Who Is It For?

Expensify is ideal for SMBs and freelancers who want an effective expense management tool. It lets you track billable and non-billable expenses for tax time, create custom reports, and scan receipts through SmartScan. You can also process reimbursements seamlessly and establish approval workflows to mark expenses for review.

Claim To Fame

Expensify excels as an effective expense tracking software compared to other accounting tools. It suits startups, small businesses, and freelancers who want to track their business expenses and create invoices that clients can settle through electronic payments, even if they’re not on the platform. Employees can also greatly benefit from its SmartScan and reimbursement management features.

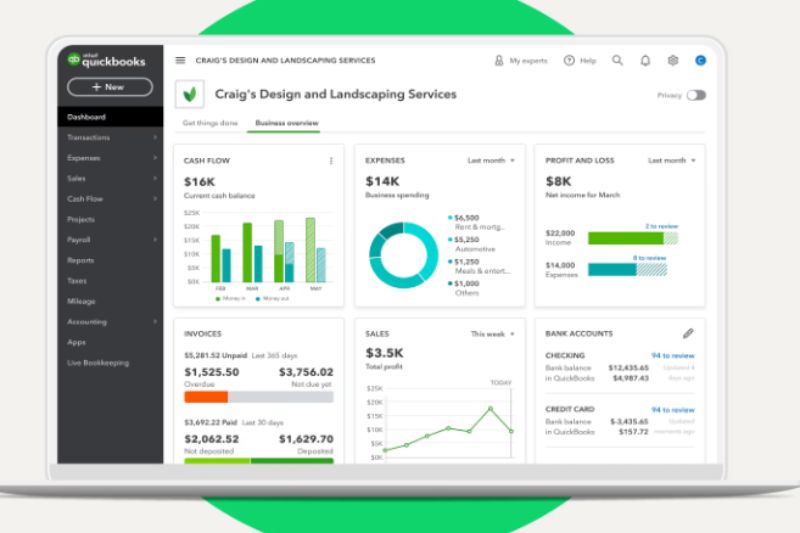

QuickBooks Online Features Breakdown

Quickbooks Online is comprehensive accounting software for businesses of all sizes. It has tools for managing your overall financial operations, including accounts receivable and accounts payable tools, expense management features, and robust financial reports. It also automates accounting processes, such as receipt scanning and expense tracking for tax preparation.

Invoicing

As a powerful accounting software, QuickBooks Online can create professional invoices. It offers a variety of customizable templates, can process recurring invoices, and generates invoices using approved estimates with one click. You can also set up a payment button on the invoice, allowing for a seamless payment process.

Expense Management

QuickBooks has tools to simplify expense management tasks, including receipt tracking and tax management. You can manage cash flow through built-in profit-and-loss statements and cash flow reports. It can automatically import and sort your expenses using machine learning, or you can create custom rules for the tool to follow.

QuickBooks Additional Features

Inventory Management

QuickBooks Online has effective stock inventory management tools that automatically update your inventory, letting you see what’s selling fast and what products to reorder. You can run reports to check a summary of the best-selling items, tax, and sales. You can also easily track your orders from each supplier and have their contact info in one place.

QuickBooks Time

QuickBooks Time is the software’s primary employee time-tracking solution. It lets you manage multiple timesheets, check who’s working, and approve time, even on your phone via the QuickBooks Workforce app. You can track job progress, create schedules, and set up recurring alerts in an activity feed.

Bank Feed Integration

You can use QuickBooks Online’s bank feed feature to fully view your finances. It lets you connect your bank accounts so your debit or credit card transactions are automatically synced to the platform. The software applies smart sorting to your credit card statements, automatically categorizing each transaction.

Integrations

QuickBooks supports a wide range of integrations, mainly with expense management tools, eCommerce platforms, CRM software, project management tools, and more. This allows you to sync data between these apps, eliminating the need to use different software for different tasks. Among its supported apps are Shopify, WooCommerce, PayPal, SOS Inventory, and Etsy.

Ease of Use

QuickBooks has a user-friendly interface containing multiple data visualization tools to help users understand financial trends without accounting expertise. Its robust dashboard lets you access various tools for all your accounting needs. You can easily create expense reports and manage cash flow through income and expense reports and profit-and-loss statements.

QuickBooks Online Dashboard

Pricing

QuickBooks has four pricing plans: Simple Start ($35 monthly), Essentials ($65 monthly), Plus ($99 monthly), and Advanced ($235 monthly). At certain times, they offer a 50-70% discount for the first three months of your subscription.. Add-ons like QuickBooks Payroll and QuickBooks Live are priced differently than QuickBooks Online.

Who Is It For?

QuickBooks is an excellent software for startups and medium and large businesses looking for a complete accounting solution. It offers tools for bookkeeping, real-time expense tracking, financial reporting, invoicing, and bank reconciliation. It also automates various accounting tasks, effectively reducing mistakes from manual data entry.

Claim To Fame

QuickBooks Online is one of the most cost-efficient tools for small business accounting. It boasts a complete set of accounting tools, like A/P and A/R features, setting up recurring invoices, managing bills, and creating customizable financial reports. It also has different add-ons depending on your business needs and supports robust third-party integrations.

Capterra Review: Expensify vs QuickBooks

Capterra shows that both Expensify and QuickBooks rate highly with users, with Expensify showing a slightly better score for ease of use. Expensify is also significantly lower in pricing than QuickBooks, but QuickBooks has many more add-ons and additional features for their pricing.

Conclusion

If you’re a small business owner or a freelancer who needs an effective expense tracking and spend management solution, Expensify is the right tool for you. It has robust features like SmartScan, bank reconciliation, tax tracking, invoicing, etc. It also has tools for expense reporting, quick reimbursement processing, and approval workflows.

QuickBooks is an excellent choice for scaling businesses that need a comprehensive accounting tool. It has robust features for financial reporting, invoicing, expense management, budgeting, and more. Since it’s one of the most popular accounting software programs, your accountant can seamlessly use its features for your business’s daily financial operations.

Curious about how Envoice can make your expense-tracking tasks more efficient? Explore its core features now and streamline your pre-accounting processes today!

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day