4 Top Quickbooks Online Features For Small Businesses

Small businesses are wonderfully dynamic and interesting entities, aren’t they? They often have the freedom to innovate, create, and deliver outstanding customer service in a way that many larger enterprises have lost due to complex organizational structures and red tape.

But with all this potential lying in the hands of small businesses there are four top challenges they face, and these are the same regardless of customer base or industry.

Today, we want to discuss these challenges and how QuickBooks Online has several features that respond to these challenges, helping you to run your business more efficiently and allowing you to focus on the very things that make your small business unique.

Let’s get right into it.

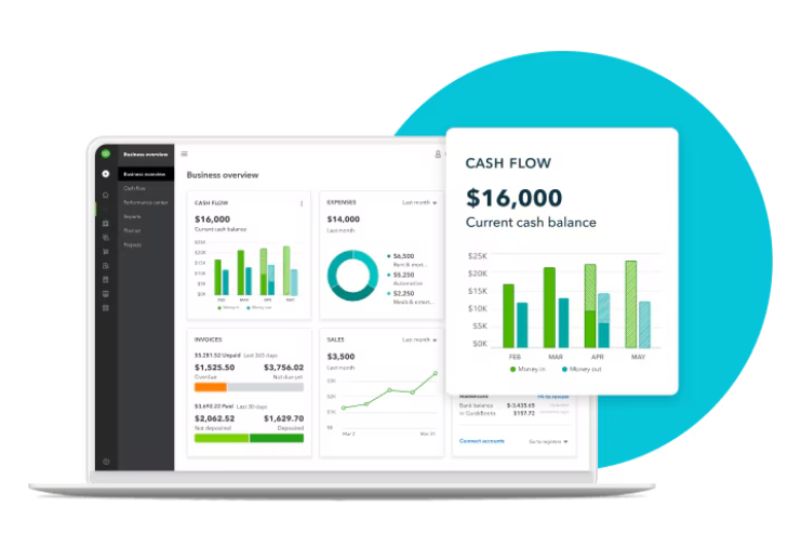

Cash Flow Management

Quickbooks Cash Flow Planner is an interactive tool that accurately forecasts your cash flow, i.e., business income and expenses. It looks at your financial history to forecast future money events. You can also adjust future money in and out events to see how certain changes will affect your cash flow. Doing this in the cash flow planner does not change or affect your books.

The cash flow planner uses historical financial data from your bank accounts connected to QB. As you send invoices, log expenses, accept payments, and manage financial transactions, QB updates the cash flow planner, giving you real-time data and a powerful forecasting tool.

Power-up this feature

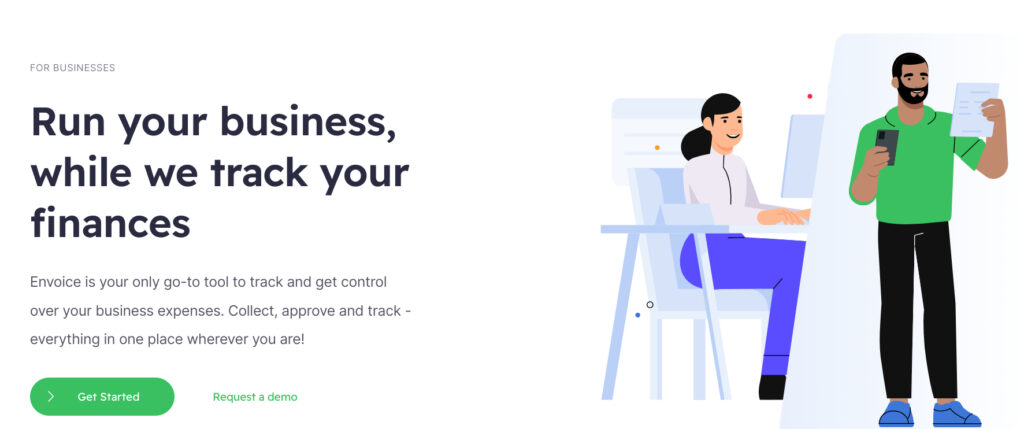

This feature will greatly enhance your business forecasting capabilities. However, if you want to boost this feature, you can also try an automation add-on like Envoice. Envoice will help you speed up the time it takes to access this critical forecasting information by eliminating manual data entry of invoices and receipts. Their sophisticated AI technology promises up to 99.9% data extraction accuracy, cutting down the time it takes to get accurate financial reports.

Cost Control

This is one area that all businesses need help with. QuickBooks Online offers subscribers expense tracking capabilities when you connect your bank accounts to QB. The software automatically imports and categorizes your expenses. You’ll be able to create customized rules for categorizing expenses and run expense reports to see every dollar you’re spending. With the QuickBooks mobile app, you can snap and save photos of your receipts on the go. Your mobile device becomes the financial expert that’s always with you.

With the expense tracking feature, you’ll never miss tax deductible expenses again, as QB highlights these expenses according to tax regulations for your state. Since you’ll always be up-to-date with income and expenses, you’ll also be able to anticipate your tax liability. Powerful stuff.

The truth about QBs AI capabilities

Expense automation is relatively new in accounting and because of this, you can expect some limitations and glitches as this technology evolves. Previously, we mentioned the automation technology offered by Envoice.

They’ve been working on this technology for a while and have had time to work out the kinks. Since this software can be fully integrated with QuickBooks, you can benefit from the superior data extraction capabilities of Envoice, and you’ll have the peace of mind that it will seamlessly sync with QB.

One added benefit of Envoice for cost control is that you can create expense templates for employees to complete and set up automated workflow approvals.

Having both QB and QuickBooks Online will give you the best of both worlds, and it won’t break the bank.

GET ENVOICE FOR $14 A MONTH

Managing Debt

The accounts payable and loan manager features work together to provide you with a comprehensive debt management tool. QB can track all your outstanding debt, including credit cards, bank loans and vendor credits. The loan manager feature helps you set up and manage loan details, including interest rates, payment schedules and due dates.

You will receive automatic payment reminders, make partial payments and track the principal and interest portions of loan payments. The software automatically updates your financial statements to reflect these transactions.

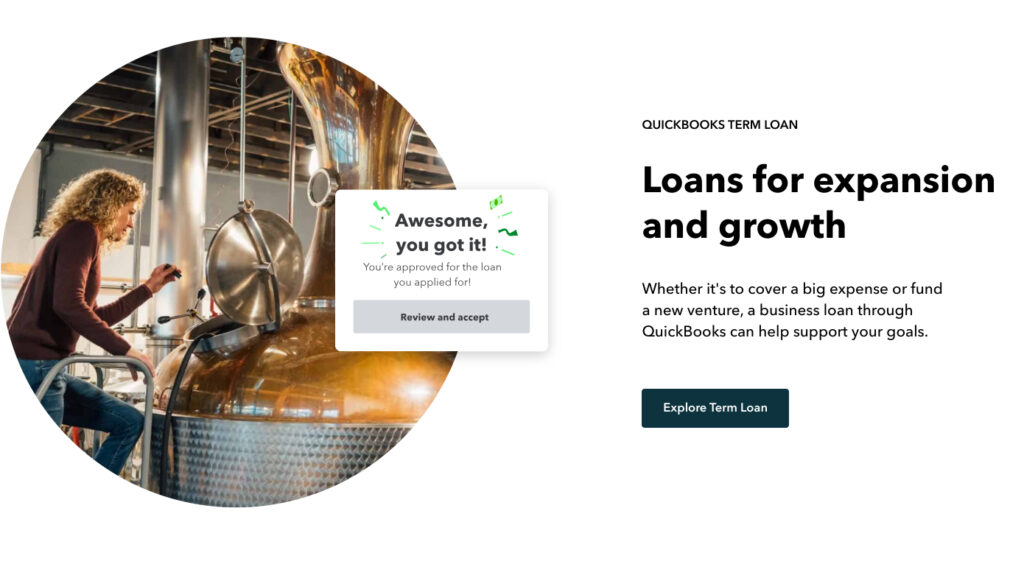

Access to Capital

QuickBooks Capital offers financing solutions for small businesses. This functionality is highly convenient because it uses QuickBooks Online data to evaluate your business’s performance and profitability. This reduces the paperwork involved in applying for a loan and speeds up the turnaround time.

When you critically need a cash injection into your business operations, QB capital could be the answer. You can apply for various types of loans, including short-term loans, lines of credit, and SBA loans. The platform will provide personalized loan recommendations based on your financial data, simplifying the loan application process.

What do these powerful features cost?

There are a number of subscriptions offered by QuickBooks, depending on the features you want to use. If you want the basic services we’ve been discussing, you can sign up for these plans.

| Plans | Suitable for | Pricing |

|---|---|---|

| Simple Start | Small businesses | $30 a month |

| QuickBooks Online Essentials | Small businesses needing to deal with multiple currencies (3 users) | $60 a month |

| QuickBooks Online Plus | Small businesses that need inventory management (5 users) | $90 a month |

| QuickBooks Online Advanced | Small businesses that need to manage complex accounting processes | $200 a month |

You should take note of something before you make your final choice. Workflow approval and custom access controls are only available with QB Online Advanced. However, there is a way to get these features without paying $200 a month.

How?

Sign up for a more affordable plan + add Envoice. Let’s say you sign up for Simple Start at $30 a month and Envoice at $14 a month. That’s still a fraction of what you’ll pay for QB Online Advanced. Problem solved.

TRY ENVOICE OUT – FREE FOR 14 DAYS

In Conclusion

QuickBooks offers a number of excellent features for small businesses to smartly manage their finances. When you consider the fact that lack of cash flow management, out of control costs, haphazard debt management, and lack of access to capital are the primary reasons for small business failure, then you can see how valuable a platform like QuickBooks can be in preventing financial mismanagement.

Combine QuickBooks Online with an affordable and yet powerful platform like Envoice, and you will have given your small business not only the best chance financially but also bring your internal controls up to scratch. It’s the complete solution as far as accounting software is concerned.

The valuable insights you’ll receive are priceless, and of course, there are a number of additional features that we haven’t touched on today that will help you expand your business in the future.

Quit trying to do everything manually and give your business a boost with QuickBooks Online and Envoice. It’s a partnership that won’t disappoint.

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day