The Ultimate Guide to Accounting Automation

Running a business is hard work, especially with an outdated accounting process. Entering data manually, routing paper documents to different departments, and archiving information makes it impossible to cut down processing time for accounting tasks without adding headcount.

But what if there’s a way to take some load off your shoulders?

What is Accounting Automation?

Accounting automation means using technology to perform tasks that people would normally do. Modern accounting systems do tasks like tracking expenses, invoicing customers, and generating financial reports.

With automation, finance professionals would no longer be entering data manually or sending emails to either request approval or follow-up. Artificial intelligence and technologies can scan source documents like invoices, enter information into the accounting software, and remind approvers that they’re holding up the process.

Is Automation Necessary If You Already Have Accounting Software?

In 1979, VisiCalc, the first spreadsheet program, made life easier for small businesses. Before then, accountants and bookkeepers had to write accounting entries manually, like in the photo below.

Spreadsheets reduce processing time for bookkeeping tasks like payroll from 20 hours to just a few minutes.[1] By 1998, Netsuite introduced cloud accounting.[2]

Computerized accounting allowed accounting professionals to reconcile bank accounts and prepare financial reports faster. While there have been many improvements since then, many accounting processes have remained manual.

Accountants and bookkeepers still do everything themselves, but rather than using pen and paper for recording, they are now entering data on computers. With automation, technologies like robotic process automation and machine learning, the actual workload for your accounting staff will decrease.

How Does Automation Change the Nature of Accounting Jobs?

According to a McKinsey report, 77% of general accounting operations can be fully automated. But how does automation revolutionize the accounting industry?

Here are some scenarios that compare how automation changes the nature of the accounting profession.

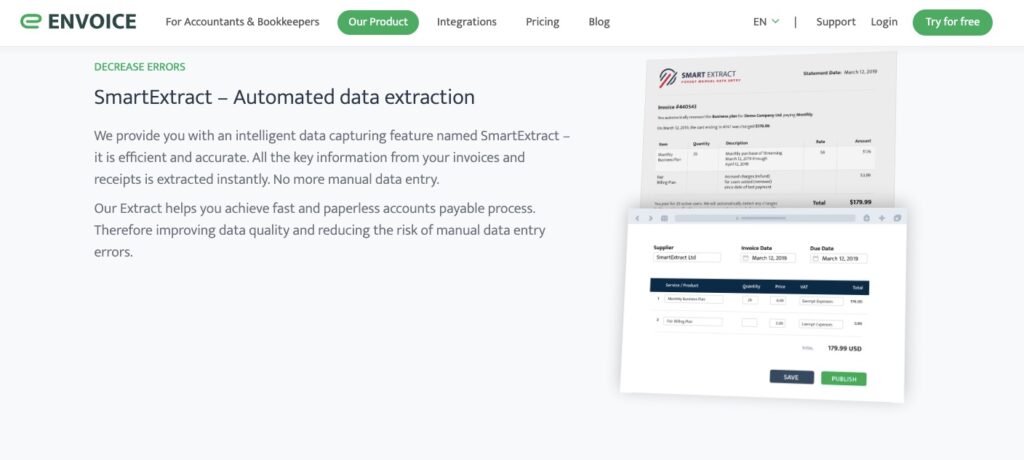

If you have a manual process, you must encode information based on an invoice to your accounting software. With a software solution like Envoice, you only have to scan the invoice, review information extracted from the invoice, and send the information to your accounting software with a click.

Here’s another example.

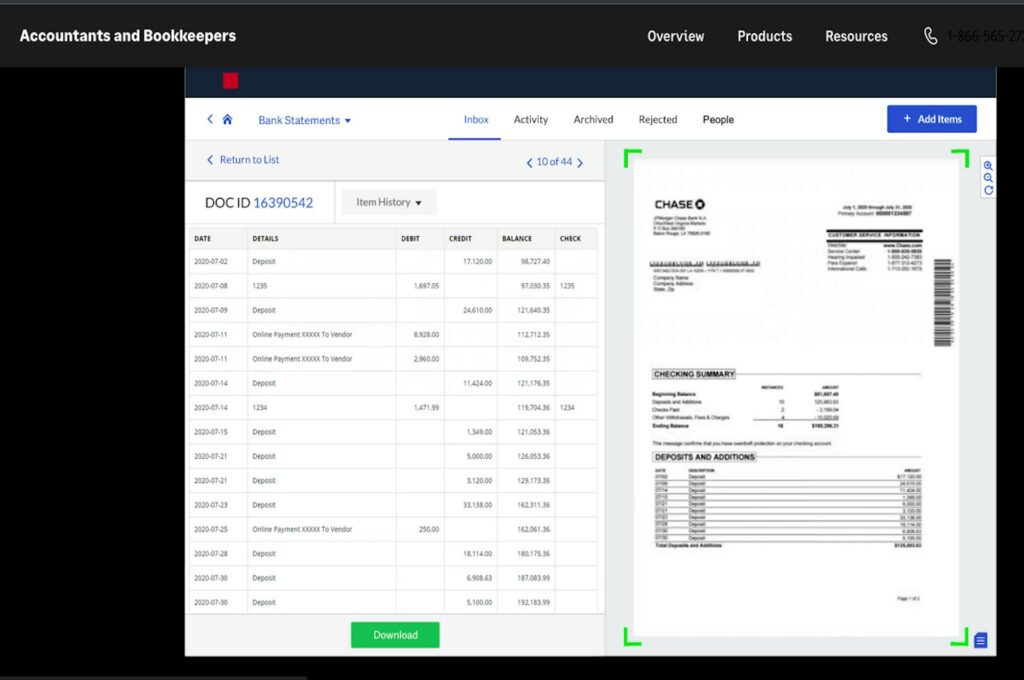

When cleaning up your accounting records to reconcile bank statements, for instance, you may see several unrecorded transactions. In a manual process, you have to enter individual transactions based on the bank statements into your accounting software. Automating with apps like AutoEntry from Sage can convert transactions from your bank statement and enter them directly into your software.

How Using Accounting Automation Software Benefits Your Business

There are many benefits to modernizing your accounting processes. Here are some of them.

Zero Human Error

A study finds that reducing spreadsheet error rates by 80 to 90% requires you to dedicate 30% of your time to inspection and testing. As long as the process involves human judgment, there will be errors.

If your accounting relies on people to enter, categorize, and process data, expect to see errors. Tiny accounting mistakes may cause bigger problems down the line since decision-makers rely on information from your finance team.

Automation addresses this problem by using bots to capture data and categorize information. Automated systems result in more accurate data and reliable accounting records.

Better Access and Availability

An automated system helps you keep track of all your financial transactions in one place. Since you have a searchable database, not a pile of folders, you can find the information you need and generate reports faster.

Modern accounting systems allow access from anywhere. It’s possible to work on the go or build distributed teams.

Improve Cash Flows

Automation helps companies improve cash flow management on two fronts. Bots can take over receivables management. You can track invoices and send reminders to customers with overdue accounts automatically.

With automation, you can also impose stricter controls over your expenses. Using an intelligent expense management system increases on-time payments to improve vendor relationships and access to discounts, better terms, and early payment discounts.

Increase Operational Efficiency for Accounting Tasks

When accounting operations are automated, they can be completed much faster. Processing data and completing reports in a shorter timespan allows quicker access to information for better decision-making.

Freeing up time is among the most tangible benefits of automation. Time saved by deploying technology can be used on strategic initiatives that could improve the bottom line directly.

Increase Compliance

Automated systems improve compliance with regulations and laws. For instance, you can prepare accurate financial reports that serve as a basis for filing your taxes.

Cleaner records generated before tax deadlines help you avoid penalties and interest charges from the IRS.

Boosting Productivity

Humans tend to get tired and make mistakes when working on repetitive tasks. With automation, you can increase productivity by freeing your team from mundane tasks that bots can do.

When tedious and time-consuming tasks are automated, your staff can focus on more important things. This can lead to better work quality and increased efficiency in your business.

Better Fraud Detection

Automation makes it easier to detect fraudulent activities. AI and Machine learning – two technologies behind automation – show promise in helping companies tighten controls and improve fraud detection. With AI, you can track all transactions and flag any suspicious activity. You can detect fraud faster and protect your business from financial losses.

Stringent Data Protection

Financial data is susceptible to theft, especially with businesses doing more activities online. Data protection should be one of your top priorities.

Automated software solutions have more capabilities to protect and secure data than manual systems. You can encrypt and store data in a secure location. You also have more control over data access and limiting controls based on the user’s authority.

Companies are also less likely to have their data wiped out when using modern accounting systems since there are backups in multiple locations.

Higher Cost Savings

Every coin saved is a coin earned!

Deploying software tools to automate accounting saves money. Automation can help you eliminate manual processes, which can be time-consuming and expensive.

For example, if you’re still using paper invoices, you’re probably spending a lot of money on printing and postage. With office workers using as many as 10k sheets of paper per year, costs quickly add up.

With automation, you can send invoices electronically, which is much cheaper. Plus, you don’t have to buy cabinets to store all those paper invoices!

In addition, automated systems can help you save on labor costs. Bots can do tasks such as manual data entry and create reports much faster than a human can.

This means you can get by with smaller accounting teams and staff or even do without an accountant. Of course, this will depend on the size and complexity of your business, but automating transactional accounting tasks will go a long way in reducing operational costs.

How Does Automated Accounting Work?

Automated accounting works by integrating your existing accounting software with other business apps. Having a feature that automatically pulls data from another system and syncs it with your accounting software creates a more efficient process.

Automated systems store data in a central location that authorized employees can access from anywhere. This makes it easy to track your finances and generate reports.

Here’s an example of automation at work when you’re processing an invoice.

With an intelligent spend management tool like Envoice, you can snap a photo of the invoice using your smartphone. Envoice automatically pulls financial data from your invoices to create a report you can edit and send for approval.

The approver receives a notification that there’s an invoice waiting for their approval. Once approved, the invoice goes to accounting, and they can sync information from that invoice to a cloud accounting software such as QuickBooks, Xero, and FreshBooks.

What Features Do Automated Accounting Systems Have?

When choosing accounting automation software, here are some features to consider

Integration With Other Business Systems

Automation allows you to integrate business software with your existing accounting software. Integrating business apps facilitate data transfer between two systems. The last thing you want is to set systems that don’t align with each other.

Ease of Use

Your automation software should be user-friendly. An intuitive interface that is easy to navigate is crucial. Otherwise, you’ll likely spend more time figuring out how to use the software than you will be using it.

Automated Data Capture

For bookkeepers and accountants, converting PDFs and images to editable text saves time. By eliminating data entry, your team can focus on reviewing for accuracy, analyzing data, and generating business insights – all of which are more valuable to running a profitable company than encoding text.

Affordable Pricing

Budget is always a consideration for any investment. You don’t want to spend a fortune on software you’re not even sure you’ll use. If possible, find a program with a one-time fee for a perpetual plan.

For software solutions with a subscription plan, find a tool with a monthly payment plan that is more cost-effective for your business.

What Types of Accounting Processes Can be Automated?

Automation is an enormous time-saver, especially during financial closing. However, other areas in accounting can benefit from using automation, such as:

Billing and Invoicing

One of the most common uses for accounting automation is billing and invoicing. Sending billing statements on time is vital to keeping cash flow moving in your business.

With automation, you can set up recurring invoices and payments to avoid worrying about them each month. Manual billing means creating, submitting, and reviewing invoices before sending them out to clients. Automation takes care of all these processes to help you save time without slacking off on reminding clients to pay on time.

Some clients forget due dates, so it’s important to send billings on time and a gentle reminder a client missed the due date. With manual invoicing, it’s easy to forget to send out an invoice, especially if there’s too much work, and this could mean losses for your business.

Aside from automating the process of sending reminders for clients to pay, you can also use intelligent systems to pay suppliers on time.

Expense Management

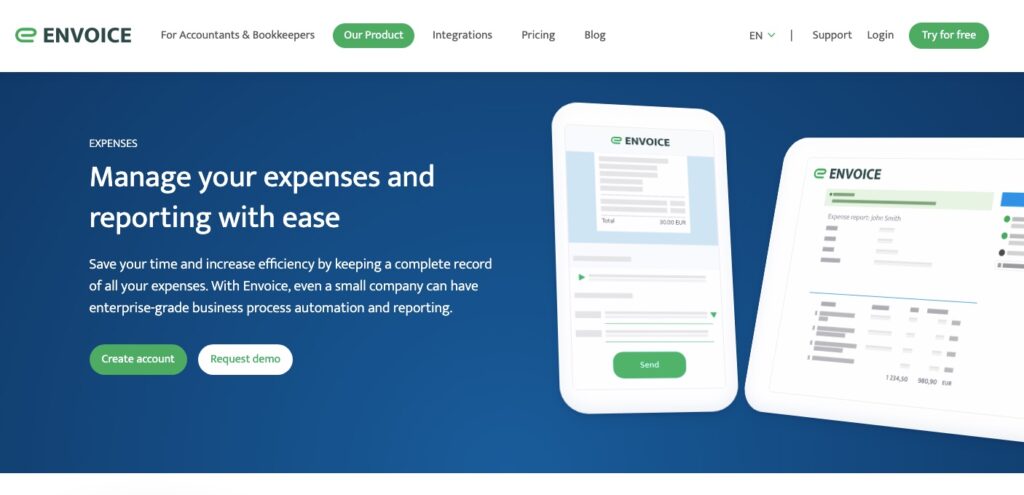

Another everyday use for accounting automation is expense management. It includes tracking expenses, categorizing them, and adding them to your accounting software. While employees, in most cases, can use their monies to make small purchases on behalf of the company, they will still need to submit receipts for reimbursement.

The whole expense management process can sometimes get messy as employees have to wait for their reimbursement. With accounting automation, employees can take photos of their receipts and submit them electronically. An efficient system in place allows you to account for all expenses and reimburse employees quickly.

No more missed reimbursements, lost receipts, or delayed approvals!

Payroll

Automation can help you keep track of employee hours, calculate payroll taxes, and generate pay stubs. This way, you can focus on running your business rather than getting bogged down in payroll details.

There will be instances that require human intervention, such as when an employee requests vacation days, but for the most part, you can automate payroll processing.

Auditing

Companies use automation not only for bookkeeping but also for making audits faster and more efficient.

Automation speeds up auditing – AI can track changes, identify errors, generate reports quickly, and detect fraud.

Reviewing financial statements and transactions, finding irregularities in existing processes, and preparing reports can be done much faster when auditors are free from admin work.

How Do You Transition Into Accounting Automation?

You might be wondering how to automate your business. Although there is no one-size-fits-all answer, you can do a few things to make the transition smoother.

Bring Your Whole Team on Board

The finance team is not the only one affected by accounting automation. Every department in your company will feel the impact of automation in some way or another. Everyone is involved, from the finance department to the accounts payable department, accounts receivable department, and marketing.

Getting feedback and input from finance and all other departments is crucial in managing change and pulling the whole team in the same direction.

Invest in the Right Accounting Software

There are tons of accounting automation software on the market. And they all have different features and pricing plans. Before investing in a software solution, consider the business needs you have to address.

The last thing you want is to end up with a tool that doesn’t solve your accounting pain point.

Sign up for a free trial first – most accounting programs offer one. Trying a program yourself is a great way to test a tool before committing to it.

Investing time in comparing systems will be worth it -and this will save you time and money in the future.

Get Help From Accounting Professionals

Ask for help if you’re not sure how to start automating the accounting process. Many accounting firms offer professional development and consulting services to assist clients in modernizing their accounting processes.

Experts can help you simplify processes, create a new workflow, find the right software, and transition to a new accounting software.

Don’t Try To Do Everything at Once

Introducing can be overwhelming. Don’t try to introduce finance and accounting workflows and process automation in one swoop. Instead, make gradual changes to accounting operations and processes.

Start small and gradually automate transactional accounting tasks as you go. Doing so will avoid any significant disruptions implementing new business processes can bring.

Identify Your Goals

Before automating your accounting and finance processes, however, it’s essential to identify your goals. What do you want to achieve with automation?

Do you want to save time? Save money? Improve accuracy?

Once you know your goals, you can start looking for ways to achieve them.

Look for Reviews

Knowing the road ahead involves asking people who have already made the journey. Once you’ve identified your goals, start looking for reviews of accounting automation.

There are plenty of online forums and websites where you can read honest reviews from real users. This is a great way to understand what works and what doesn’t. Most automated accounting software will also have reviews on their websites.

Check Out the Competition

When looking for accounting software, it’s good to check out the competition. See what they’re using and how they’re using it. This can give you some great ideas for automating your accounting processes.

You can also learn a lot from their mistakes. By seeing what doesn’t work for them, you can avoid making the same mistakes in your own business.

Is It Better to Add More Employees or Automate?

As your business grows, you’ll eventually reach a point where you need to decide between hiring more staff or accounting automation. Both have their pros and cons, so it’s crucial to weigh your options carefully before deciding.

Hiring more staff will give you more hands on deck to get work done. On the other hand, accounting automation will save you time and money in the long run.

While adding headcount seems necessary, training can be expensive and time-consuming. Talent shortage also makes it more challenging to fill jobs. Automation, on the other hand, makes it possible to do more while maintaining a leaner team.

An automated accounting system creates value for years to come, it is cheaper to maintain, doesn’t have sick days, and can work round the clock.

In the end, the right mix of people and automation is necessary for running a profitable business. Consider the nature of the job to decide what’s best for your business.

Conclusion

With the sole aim of reducing accounting costs, automating your bookkeeping processes is a no-brainer. Research and find the right software for your business needs.

In 1985, Microsoft created Excel for Apple computers, but a PC version quickly followed.[4] Since then, businesses and pencil-pushing bookkeepers never went back to using paper ledgers. Computers made accounting too easy and efficient to return to those dark ages.

More than 30 years later, most accounting and finance professionals use spreadsheets. While this technology still works, it may be time for another accounting revolution – a process that automates your workflows.

If you’re still using an antiquated accounting system and you’re struggling to keep up, consider upgrading. Your business (and your bottom line) will thank you for it.

Automate Your Accounting Process Today

The sooner you start to automate accounting processes, the sooner you’ll see results. Lagging behind the competition is not an option in the fast-paced business world.

It could be why you haven’t launched into new markets or haven’t scaled your business. Automation can help you take your business to the next level by improving productivity, increasing efficiency, and allowing you to focus on growing your company.

If you’re thinking of making the switch, don’t wait; take the bull by its horns!

Explore Envoice Expense Automation solutions and start automating a big chunk of your accounting tasks now.

Article Resources:

[1]https://www.britannica.com/technology/spreadsheet#ref850101

[2] https://www.netsuite.com/portal/resource/articles/erp/erp-history.shtml

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day