Most Advanced Accounts Payable Automation Vendors in 2025

Accounts payable (AP) automation has become a game-changer for businesses looking to improve overall cost efficiency, reduce internal errors, and strengthen financial control. In 2025, the most advanced AP automation software leverages artificial intelligence (AI), machine learning (ML), and seamless integration to streamline invoice processing and payments.

Modern finance teams are increasingly turning to ai powered ap automation to unlock deeper efficiencies across the entire invoice lifecycle. This approach goes beyond basic rule-based processing by using intelligent workflows, predictive coding and real-time anomaly detection to support more accurate and resilient AP operations. It offers a practical look at how AI is reshaping day-to-day tasks and strengthening overall financial control.

For businesses seeking the latest innovations in AP automation solutions, here are the top vendors offering the best-in-class accounts payable automation software.

Vendor Snapshot: A Quick Comparison of Popular Automation Tools

| Vendor | Best for | AI powered invoice processing | Smart approval workflow | Payment processing | Expense management | Mobile application |

| Envoice | Small business & accountants | ✅ | ✅ | ✅ Secure payments | ✅Smart expense tracking | ✅ |

| Bill.com | Growing businesses | ✅ | ✅ | ✅ACH, credit cards | ✅Automated expense reporting | ✅ |

| AvidXchange | High-volume invoice processing | ✅ | ✅ | ✅B2B payments | ✅Spend visibility tools | ✅ |

| Stampi | Team collaboration | ✅ | ✅ | ✅Vendor payments | ✅Expense reconciliation | ✅ |

| Tipalti | Global payments | ✅ | ✅ | ✅Multi-currency | ✅Global expense compliance | ✅ |

| Melio | Small business payments | ✅ | ❌ | ✅ACH, credit card | ✅Expense categorization | ✅ |

| SAP Concur | Large enterprises | ✅ | ✅ | ✅Corporate cards | ✅AI-driven expense optimization | ✅ |

| MineralTree | Mid-sized businesses | ✅ | ✅ | ✅ACH, check, virtual card | ✅Automated reconciliation | ✅ |

| Quadient AP | End-to-end automation | ✅ | ✅ | ✅B2B payments | ✅Expense fraud prevention | ✅ |

2 Most Advanced AP Automation Software: An in-depth look

1. Envoice

Why choose Envoice?

Envoice is a powerful yet easy-to-use accounts payable automation solution designed specifically for accountants and SMEs. It digitizes invoice capture, approval workflows, and expense management, providing cutting-edge automation technology that is missing in some popular accounting software. Its advanced data extraction capabilities offer a 99.9% accuracy rating when combining features, SmartExtract and ExactExtract. Furthermore, its smart workflow approval feature which allows digital invoice approvals, saves more than 8 hours a week, speeding up the accounts payable process.

Key features:

- AI-powered invoice data extraction for accurate invoice processing and elimination of manual data entry.

- Automatic categorization of expenses.

- Automated approval workflows to speed up invoice approvals and other AP processes.

- Seamless integration with Xero, QuickBooks, Sage, MS Dynamics 365, OneDrive, Coop Pank, and Wise.

- Smart expense management tools for better cost control and cash flow management.

- Empower employees with a mobile app for easy submission and real-time tracking of their expense reports.

- Customizable reports and real-time insights.

- Add your entire team at no additional cost – enjoy unlimited free users.

What Customers Think about Envoice

“The most important goal for us was to speed up the process of managing invoices while also keeping it transparent. Another important factor for us was the exchange of data with our accounting software, a feature nicely available with Envoice.” (Marianne Reinsoo, Accountant, Hausers Group).

“When having business negotiations with new clients, we see future potential in Envoice as their solution really is powerful and ensures that saved time makes it possible to serve new clients without hiring extra staff” (Helge Ollema, Manager, AMELLO)

Business Case Study for Envoice: Amello Accounting

Just before starting to use Envoice, Amello made a huge leap in switching from paper invoices to PDF and e-invoices.

After going paperless, technical solutions were sought after that would simplify inserting data from pdf invoices into the accounting software. The solution was to copy data from individual fields, which made data entry quicker but still meant that all the fields had to be inserted one by one. Depending on the accounting software, the possibilities of copying and entering data were different.

How did Envoice solve this problem?

Amello works with a variety of accounting software and it was important that the automation tool could integrate with all of these software. This was possible with Envoice. Envoice also solved the problem of lost receipts, enabling Amello clients to scan physical receipts immediately with their phones. This provided a seamless connection between the client and Amello accounting’s systems. No more time consuming follow up on lost receipts.

Amello clients further reported that the workflow approval feature saved time on data entry, and productivity increased. Overall, Amello assessed Envoice to be a powerful system with future potential for increasing business efficiencies.

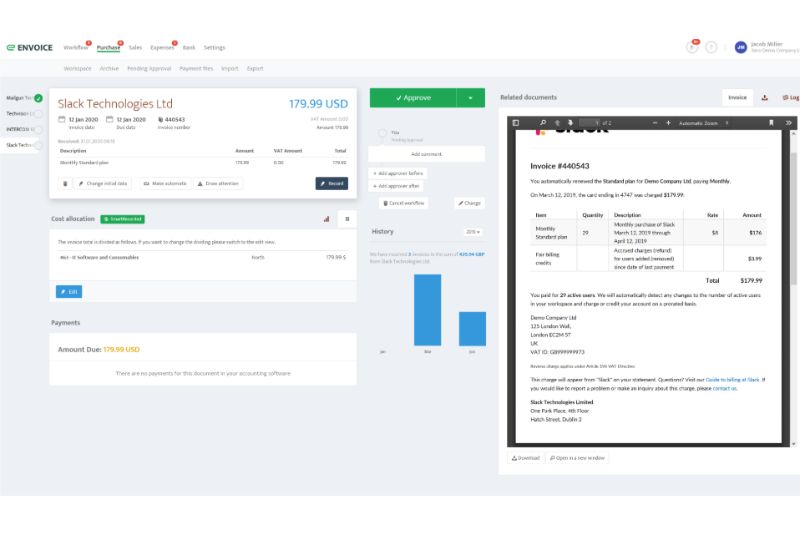

Envoice Screenshot: Invoice processing workflow

Envoice Invoice Processing Workflow

This screenshot showcases Envoice’s invoice processing workflow, and in this image you can see the following elements:

- Invoice overview (top left): Displays the invoice summary for a quick snapshot and provides options for cost allocation, marking as paid, and flagging issues.

- Approval workflow (centre): Green approve button provides a quick approval option (a key element in the best AP automation software). Further options for adding approvers are also given.

- Cost allocation history (left side): Highlights historical cost allocation to ensure correct expense tracking.

- Payment status (bottom left): Provides the outstanding amount due, and syncs this amount with accounting software for accurate records.

- Related documents (right side): Displays the original invoice for reference and verification by approvers.

Providing the finest in invoice automation, Envoice gives finance teams the ability to easily process invoices, and fast track payments to secure early payment discounts, and reduce invoice processing costs. Transparency is possible in all financial processes, throughout the entire AP lifecycle, a benefit that translates into reduced duplicate payments, better fraud detection, and compliance.

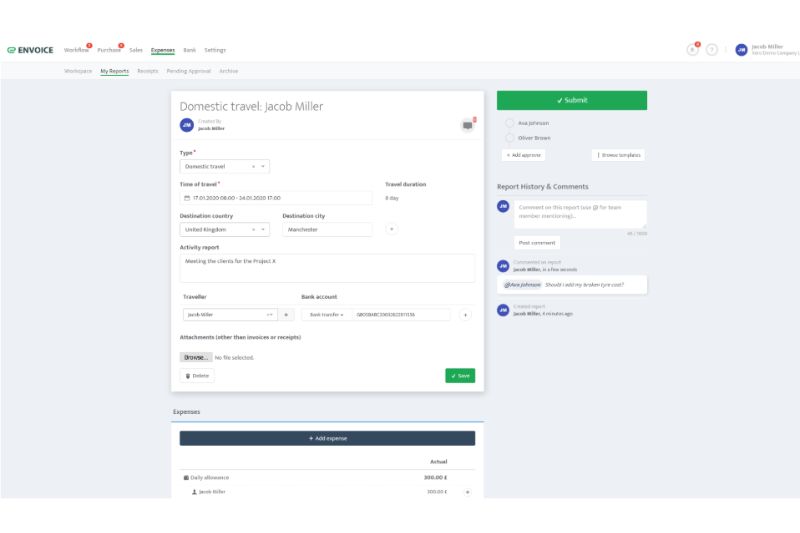

Envoice Screenshot: Expense reporting

This Envoice screenshot focuses on expense management and reporting. Here is a breakdown of the key functions in this workflow:

- Expense report (top left): Form where all the expense details are inserted, and includes the purpose of the expense and the reimbursement bank accounts.

- Expense submission and approval (top right): The green ‘submit’ button allows users to electronically submit expenses for approval.

- Report history and comments (right side): All AP automation work is tracked by the system, giving the users, and approvers the ability to see progress.

- Expense details (bottom left): Users can add individual expenses and supporting documents. The system automatically calculates the total of the expenses.

Envoice expense reporting workflow

The expense reporting function streamlines this process for AP teams, eliminating manual tasks and duplicate data entry into different ERP or accounting systems.

Envoice Summary

Envoice offers powerful and technologically advanced AP automation software for accountants and SMEs who need the ability to process invoices quickly and accurately, and digitize workflow approvals.

Invoice data is extracted with precision in seconds to minutes, and machine learning capabilities increase this efficiency over time, as the platform learns more. This ability to self-learn, and self-correct is what sets this AP software apart.

Envoice has made automated invoice processing highly affordable and available to business at every level with their competitive pricing structure, and easy to use (and integrate) system.

2. BILL.com

Why choose BILL.com?

BILL.com is a leading financial operations platform that streamlines accounts payable (AP) and accounts receivable (AR) processes for businesses of all sizes. By automating bill payments and invoicing, this AP automation tool reduces manual tasks, minimizes errors, and enhances financial visibility. 93% of users agree BILL is easy to use, and 95% agree AP is more automated with BILL. [1]

Key features:

- Invoice capture and data extraction: The system utilizes AI-powered technology to automatically import and extract key details from invoices.

- Customizable approval workflows: Workflows route invoices to the appropriate approvers, ensuring timely review and payments.

- Seamless integration: Syncs with populare software like QuickBooks, Xero, and NetSuite. This maintains consistency across accounting software.

- Electronic payments: Supports various payment methods, including ACH, credit cards, and international payments.

- Audit trails and compliance: The platform maintains detailed records of each transaction and approval, facilitating audits and ensuring internal compliance.

- Mobile application: Users can manage AP processes on the go via the mobile app, increasing speedy processing times, and cost savings.

What Customers Think about BILL.com

“BILL has reduced our payment processes by 80%. BILL is very easy to use and provides appropriate reports for us to use for accounting. Being a small organization, the time to process payments, obtain appropriate approval processes, and send out timely payments has helped our organization streamline our accounts payable process.” (Banbie Hayes-Brown, CEO, Georgia Advancing Communities Together)

“Using BILL has reduced bookkeeping time by 70%. We can get checks and ACH payments processed online, we have an audit trail and good internal controls for our bookkeeping staff and our clients. It has been a win-win for our time management and our clients bills getting paid on time and properly documented.” (Audrey George, CEO, ANC Accounting)

Business Case Study for BILL.com: BetterRX

BetterRX, a pharmacy services provider, sought to optimize its accounts payable process to save time and increase efficiency. By implementing BILL.com BetterRX automated its AP workflows, resulting in time savings and improved financial operations.

How did BILL.com solve this problem?

When BetterRX introduced BILL.com into their business, they received the following benefits:

- Simplified contractor payments and international vendor payments.

- The elimination of a paper-based filing system because BILL stores all document copies in a digital format.

- The ability to import invoices into QuickBooks easily without having to retype information, leading to errors.

- More effective cash flow management with an open payable report.

- Better control over expense spending, and fewer missing receipts.

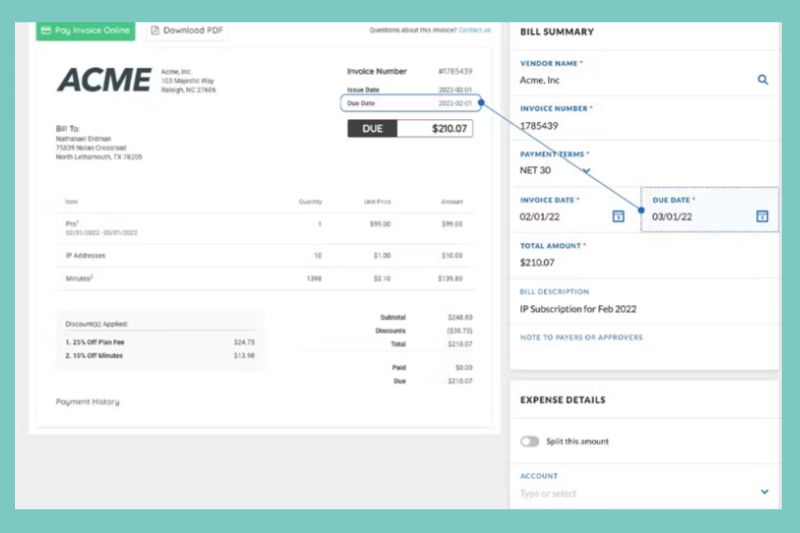

BILL.com Screenshot: Invoice processing workflow

Image courtesy of Capterra

This screenshot displays the BILL.com invoice processing workflow. The main elements are as follows:

- Bill summary (right side): Shows a summary of the invoice with notes for payers or approvers.

- Invoice overview (left side): Displays line items with descriptions, quantities and pricing. This will include discounts and payment history. Green ‘pay invoice online’ button (top left) allows the immediate payment of the vendor.

- Expense details (bottom right): Provides the ability to split the amount into a number of accounts, and give accurate descriptions of each split.

The system extracts key details which reduces the need for manual data entry, and has the ability to categorize expenses immediately. Users can review and pay the invoice on demand, making the entire accounts payable process faster and more efficient.

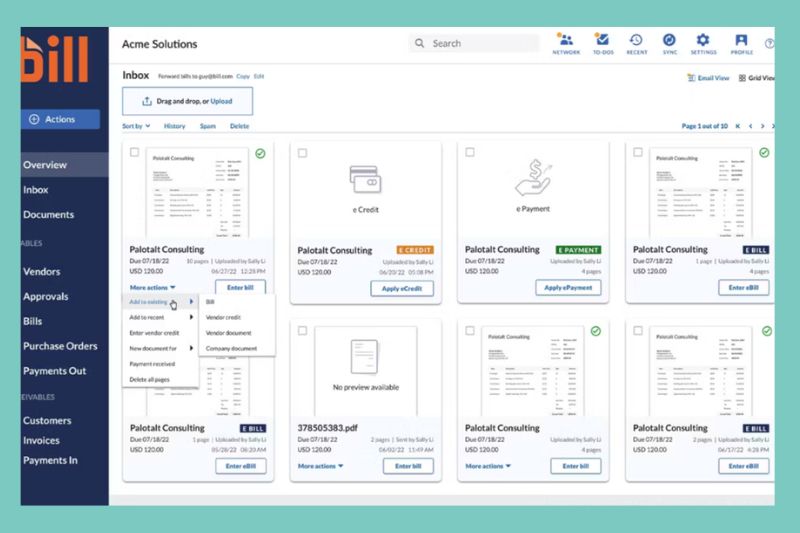

BILL.com Screenshot: Invoice processing inbox

Image courtesy of Capterra

The screenshot displays the BILL.com invoice processing inbox, showing an organized document management system for handling payables. The key elements displayed here are:

- User interface overview (left side): This menu allows you to access all the key functions of the accounts payable process, giving users real-time data on which to make business decisions.

- Invoice inbox panel (centre): Shows multiple incoming invoices that require attention from an approver. Different status levels are assigned to each invoice such as vendor credit, e-payment, and e-bill which is ready for processing.

- User drag-and-drop: Allows users to manually upload new invoices for processing, sort invoices based on due date, vendors, or status, and directly process an invoice.

The BILL.com system recognizes uploaded invoices and extracts key data, assigning the invoices for review before processing payments. It also enables the tracking and application of credit against invoices, while ensuring seamless payments and financial data synchronization with the ERP or accounting system.

BILL.com Summary

BILL.com is a leading AP automation solution designed to streamline invoice processing, approvals, and payments for businesses of all sizes. Leveraging AI-powered automation eliminates manual data entry, reduces human errors, and speeds up invoice processing. For a side-by-side comparison with another popular platform, check out our Melio vs bill.com guide.

In addition to invoice automation, BILL.com offers automated approval workflows that improve compliance and provide a transparent audit trail. The platform integrates seamlessly with QuickBooks, Xero, NetSuite, and other major accounting systems, ensuring a smooth flow of financial data. Businesses can also customize approval processes, set spending limits, and enforce internal policies to maintain financial control.

BILL.com stands out with its diverse payment options, including ACH transfers, international payments, virtual cards, and paper checks and provides a reliable and scalable AP automation solution tailored to modern business needs.

Conclusion

Taking a deep-dive into two of the most advanced AP automation software on the market, we examined the platforms, Envoice and BILL.com. By leveraging AI technology both platforms provide companies with the ability to implement automated accounts payable processes quickly, and most importantly, in a cost effective way.

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day