5 Advanced Benefits of Automated Invoice Processing

Produced by our content partners and reviewed by Envoice’s internal experts to ensure it reflects real accounting workflows and accurate product usage.

For a long time, not much has changed in accounting practice, but now automated invoice processing or accounts payable automation has turned this trend on its head.

As one report shows, automation technology is increasing steadily in the accounting industry, and with this change, businesses, and accounting professionals are being forced to question their current AP practices. The decision facing them is: Does automation add enough value to warrant its implementation?

That’s the question we’re going to answer here today.

What is automated invoice processing?

As so often happens with a new technology flooding the market, terminology can get confusing and also misused.

We believe it’s important to define what we’re going to be discussing the benefits of.

Automated invoice processing is the introduction of invoice automation software into an invoice processing workflow, to bring about the faster, and more efficient processing of invoices – reducing human error, eliminating duplicate payments, decreasing fraud, and increasing the impact of internal controls.

You might also explore how this platform leverages ai invoice processing to further automate data extraction, routing and payments with minimal human intervention. By linking automation with artificial intelligence your accounts-payable workflow moves from “automated” to truly smart and adaptive.

Put another way – you procure software to do the niggly, time-consuming tasks, and act as another pair of trained eyes during your entire invoice processing workflow.

For new users, this beginner’s guide to automated invoice processing offers a helpful foundation for understanding how automation works and the common benefits that can be achieved by all businesses from using it.

Advanced Benefits of Automated Invoice Processing Software

1. Greater visibility and control over financial information

Invoice processing automation offers a level of financial control and insight that simply cannot be matched by manual data entry and management.

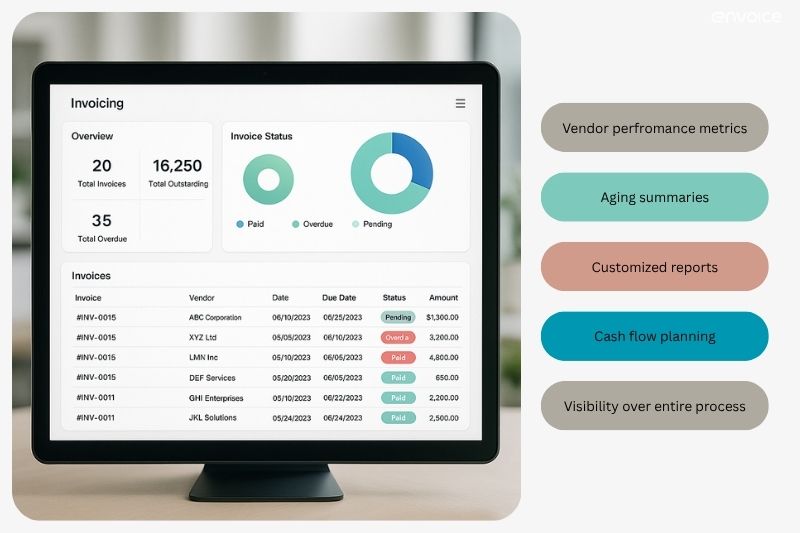

By integrating an automated invoice processing system into your ERP and accounting systems, you receive powerful insights into cash flow trends, vendor performance metrics, ageing summaries, and exception rates. Accounting staff will be able to easily identify which vendors invoice late, where approval delays are coming from, and which internal controls are not fulfilling their function.

For example, a CFO could use real-time dashboards to visualize the entire AP cycle from receipt of the invoice to payment. Invoice data can be dissected with the help of customised reports, segmented by vendor or payment terms. In larger companies, a procurement lead might use automated systems to prioritise preferred vendors, by evaluating their reliability and early payment discounts.

From a finance team’s perspective, this level of insight translates into more accurate cash flow management. For instance, by understanding when large volumes of invoices might hit the workflow (like end-of-quarter vendor billing cycles), resources can be planned proactively. 53% of respondents in one 2024 AP study cited improved reporting and financial analytics as one of the top priorities in the accounts payable field.

Automation systems can provide the business case for process restructuring

Taking just one example of automated workflows, using a system for processing invoices allows you to introduce tiered thresholds, parallel approvals, or automated routing based on invoice type, amount, or vendor history.

This kind of realignment not only decreases processing time but also ligns workflows with internal controls and audit frameworks.

These insights allow the finance leadership to evaluate what works and to dispense with what doesn’t. As operational efficiencies become sharper, the cost of individual invoice processing can be reduced, and opportunities that increase revenue (such as early payment discounts) can be capitalised upon.

The kind of transformation we’re discussing here is highly appealing to a business because it elevates the finance function from a transactional execution to strategic and financial leadership. When the management of manual processes no longer consumes the time of your finance team, they are free to think creatively and tackle real accounts payable issues.

For a comparison of leading accounts payable automation solutions and how they provide greater clarity over your financial operations, see 4 Best Electronic Approval Software for 2025

2. Scalability for growing businesses

As a business grows, so does the volume of its invoicing, and even the complexity of its invoicing process. A study by Ardent Partners shows that manual invoicing becomes more error-prone and time-intensive with scale, often resulting in bottlenecks, missed vendor payments, and increased processing costs. [1]

Without the benefit of automation, the manual invoice processing workflow quickly becomes about hiring additional resources to maintain service levels – a costly exercise with very real limitations on agility, consistency, and cost-efficacy. Automated invoice processing, on the other hand, disrupts this cycle by decoupling scalability from headcount expansion.

An invoice automation solution, by contrast, offers:

- Seamless adaptation to peak payment processing periods.

- Automatic integration of approval parameters according to internal protocols.

- The ability to grow operationally without proportionate increases in administrative overhead.

How does automated invoice processing work behind the scenes?

How does an automated invoicing system achieve this level of organisational advancement?

With modular architecture, cloud-based infrastructure, and advanced AI technology. These accounting systems are specifically designed to accommodate spikes in invoice volume without performance degradation, and they support multi-entity, multi-currency, and multi-language operations. These elements are essential for growing a business. For further insights, see Cloud-Based Accounts Payable Solutions for Efficient Management.

One company that successfully implemented the Envoice automation tool reported their ability to revolutionise their workflow, and increase document processing by 2x, making their operations significantly more efficient.

3. Strategic use of invoice data

Supplier invoices hold important business intelligence such as vendor pricing trends, company purchasing patterns, seasonal purchasing fluctuations, and more. Automated invoice software captures and organises this information in a way that holds the potential to transform business operations.

For instance, a company processing vendor invoices for six months or more may discover that one particular supplier has greatly increased the prices over this period. This could prompt an investigation, a review of the contract, or a renegotiation of prices. With only paper invoices and a fragmented data collection process, this kind of data is not easily detected.

Automation can also surface seasonality patterns much faster than traditional methods, better informing procurement practices and the timing of large raw material purchases. This is particularly helpful in sectors with complex supply chains, as these insights help predict material costs and align purchasing strategies to real data.

Ultimately, automation transforms invoice data from a passive record to a highly valuable tool for smart financial management.

Learn how Envoice supports this transformation with features tailored for real-time insights and approvals, cost savings, and invoice management.

What can be learnt from invoice data?

A typical dashboard in the right invoice automation software can display the following insights from the invoice data it has collected:

- Average number of days it takes for invoices to move from receipt to payment.

- Where bottlenecks are occurring for particular types of invoices or invoice amounts (as per approval controls).

- Real-time payment analytics, month-on-month.

- A list of high-risk invoices flagged based on internal rules. This can be invoices flagged for excessive amounts or missing line items

4. Strengthened vendor relationships

Traditional invoice processing is not the most effective way to get the best out of your vendor relationships. The reason for this is that it is not competitive enough against companies that are actively automating their accounts payable process. Vendors want timely payments and for this they are willing to give discounts, and preference to their better paying customers.

Vendors rely on predictable and accurate payment cycles for their cash flow stability, and also to maintain their supply chains. When invoices are misplaced, there’s a long invoice processing time, or customers process invoices manually, it disrupts that much-needed cash security.

Smooth facilitation of vendor relations

Automation accounting software is instrumental in acting as a bridge on which strong and lasting vendor relationships are built.

How is this achieved?

By initiating structured workflows and automatically paying supplier invoices that are eligible for this kind of treatment. These systems can also generate automated payment acknowledgements and allow vendors to track the invoices through their vendor portal.

In short, the automation tool acts as a mediator to ensure a smooth vendor relationship, from which you reap all the ancillary benefits.

5. Improved compliance and audit readiness

Companies are under the burden of increasingly complex tax laws, regulatory compliance, and data privacy laws. For an accounting team, this amplifies the administrative burden, but automation holds the key to solving this problem.

By standardising documentation, enforcing policy adherence through system logic, and maintaining accurate audit trails, automation responds dynamically to these concerns.

For those unfamiliar with the term system logic, it refers to the built-in rules and conditional workflows that govern how invoices are processed, by whom they are approved, and how they get paid.

For example, for invoices above a certain amount, rules can be set to require multi-level approval, but for trusted recurring invoices the rules can automatically route the invoice for payment approval.

The validation logic will cross-check tax codes, invoice numbers, and purchase orders to ensure compliance with internal regulations.

This rule-based engine eliminates guesswork, picks up fraudulent invoices, validates multiple invoices for one supplier, and reinforces audit protocols. This significantly reduces the need for manual judgment, giving accounting teams a structured and defensible framework in which to operate.

Addressing automation integration concerns

While the benefits of automation are compelling for businesses, there are concerns about its adoption into business practice. These concerns are understandable, and here we deal briefly with the top three concerns brought up by those interested in this technology.

Concern 1: This will be too complicated to implement

Business owners and accounting teams rightly worry that adopting an automated system will cause more problems than it will solve.

Major concerns revolve around disruption of the AP process, the costs associated with the implementation, and the technical knowledge that will be lacking. In reality, modern automation tools are specifically designed to integrate with existing accounting systems and ERPs.

Many vendors also offer assistance through phased implementation and white-glove onboarding to minimise disruption. The costs associated with automation have been much reduced vs its initial introduction into the marketplace, mainly due to the competitive nature of this industry.

Concern 2: Loss of control over approvals and oversight

This is a common misconception that needs to be dispelled.

The truth is that automation enhances control and compliance (as discussed earlier). Tiered approaches to workflow approval, and customizable rules for approvers and escalations, completely address the worries associated with approvals.

If you’re not convinced that automation tools can give you the level of control you want, you need to see it in action by booking a demo. Working through all your questions with an experienced user is the only way to get your questions answered.

Concern 3: Will I lose my accounting team?

The main focus of automation is not to eliminate the need for human intervention but rather to evolve accounting roles into more strategic functions.

Businesses interested in automation seek its benefits to relieve highly skilled employees from repetitive manual tasks that do not add as much value as higher-level accounting functions. As long as your business remains committed to upskilling your accounting team, there should be no reason to lose members of your team. Of course, this doesn’t account for teams that are overstaffed – even for implementing the manual process – this is a separate issue.

Conclusion

Automated invoice processing is no longer a novel or discretionary option for businesses to fast-track their invoice processing. It has become a widely accepted operational standard worldwide, with forecasting, planning, budgeting, procurement, fraud and compliance management, and invoice exception handling taking top place amongst the concerns of business leaders. [1]

Beyond the basic advantages of automation, which include enhanced accuracy, fewer errors, cost reduction, faster approvals and shorter payment cycles, it also offers the more advanced benefits of:

- Greater visibility and control over financial information.

- Scalability for growing businesses.

- The strategic use of invoice data.

- Strengthened vendor relationships.

- Improved compliance and audit readiness.

With a strategic automation partner like Envoice, intelligent document processing moves from the realm of imagination to the realm of reality. Read about the success other companies are experiencing with Envoice, with Accounts Payable Automation Case Study: 3 Success Stories

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day