How Many Clients Does A Small CPA Firm Have On Average?

In the heartland of the United States, a small CPA firm has 10 employees and 50 clients; in Frankfurt, a small accounting firm has 20 employees that serve 75 clients. In South Africa, a CPA firm has 5 employees and 40 clients.

All these firms provide the same services to their clients:

- Tax services

- Advisory services

- Tax planning services

- Bookkeeping services

- Cash flow management strategies

- Personal tax returns

- Retirement planning

- CFO services

Why are we telling you about these firms? Because they all suffer from the same problem. Regardless of their size or the current number of clients they serve, they can’t go beyond this capacity. They’ve got a basket of great services but their business model cannot sustain any further growth.

This is where we come to the reason you’re here.

You see, it doesn’t matter how many clients you currently have. If you’re here, it means you either think your firm doesn’t have enough clients or you have too many, and you want to know what you can do to manage the situation.

Either way, fewer clients are a problem and too many clients are a problem and we’re about to discuss what you can do as a business owner to stay ahead of your challenges.

Small accounting firms will always be looking for a way to level the playing field and do more with less. That’s pretty much how business works. We believe that automation of bookkeeping tasks is the only way to go and in this article, we put forward this solution as a feasible option for your firm’s growth.

Time and resource thieves

The average accounting firm (small CPA firms) has anything from 20 to 150 clients. The number of existing clients varies greatly according to the location, season, services, and reputation of the firm. However, all of the firms have common issues. Let’s look at some of them.

Tax Season

This is the first headache experienced by accounting firms. That time of the year when personal and business tax returns have to be submitted and all hands are on deck to make it happen. You all know what we’re referring to.

The large volume of paperwork that has to be processed. Manually entering data into the accounting system to generate accurate financial reports. The clients that didn’t keep accurate track of their expenses and the invoices that don’t agree with the final sale figures.

What do you do around this time?

- Do you hire extra staff?

- Do you work a crazy amount of overtime?

- Do you outsource the data entry?

- Do you hire independent accountants to take on the extra work?

You do what you have to do when the going gets tough. But there is another way.

That way is automation.

Automation – your secret weapon during tax season

Ok, so what do we want to achieve here? You want to do a huge amount of work in the shortest time possible with the least number of staff members. Every business owner’s dream. Is it possible? Yes!

Put an end to large volumes of printed documents

With an automation tool integrated into your existing accounting software, you can encourage your clients to send in their documentation electronically by email or by scanning an image of their invoices and/or expenses with their phone and sending it via an app.

They no longer need to keep all their paper receipts and slips because they will simply scan them into the system for processing, and you get the benefit of having all your client’s documentation in one place where you have easy access to it all.

One point of communication with your clients

By integrating an automation tool with your current platforms, you can have all your communications in one place. You can also manage this communication by assigning tasks to your team that you have pre-set or that you allocate with the press of a button.

There is visibility for everyone who needs it and an option to restrict access to sensitive documentation for those who don’t need to work with it.

Say goodbye to manual data entry

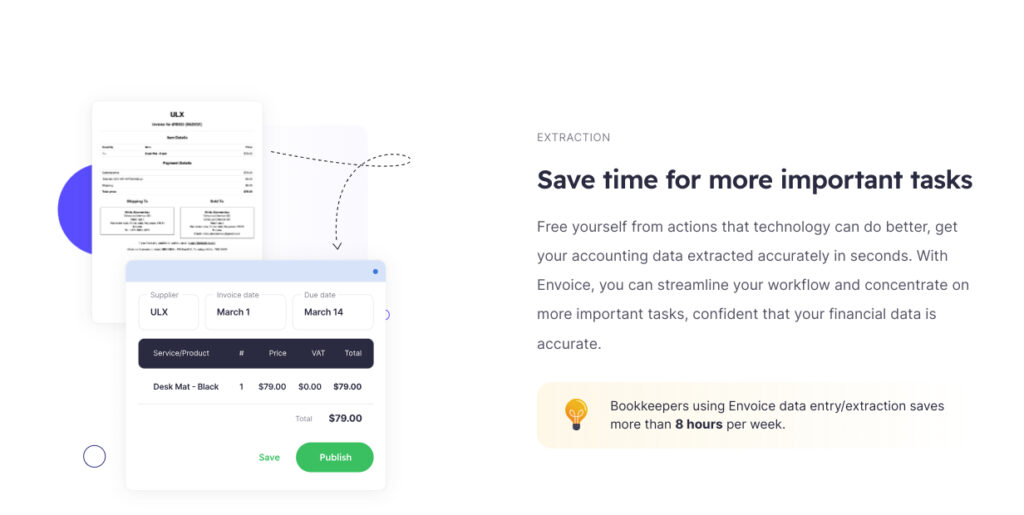

With automation, you can streamline your processes and allow a supersmart machine learning capability called data extraction to pick up all the details from your emailed documents. It brings into your accounting software, and with a 99.9% accuracy, this technology is likely to be the most valuable investment you make in the growth of your accounting firm.

Set up rules and work even faster

You don’t have to start from scratch. Create your own custom rules to streamline your workflow and eliminate repetitive actions. Automation platforms allow you to set up rules for categorization, approval, and more, so you can spend less time on manual tasks and focus on growing your business.

A tool for accountants, by accountants

Accounting automation firm ENVOICE has developed an innovative product in conjunction with accountants and bookkeepers. Since this product was developed by professionals, for professionals, you can be sure they’ve developed a tool that does most of your pre-accounting work for you and frees up the time of your accounting staff to do more important tasks.

Demo the ENVOICE automation tool

This tool extracts data within seconds and gets better at it the more it handles your documentation. Accountants and bookkeepers who currently use ENVOICE save more than 8 hours a week on data entry tasks. That’s an entire working day that can be used for client retention tasks!

A Business Case Study

How e-Residency Hub serves over 800 customers with Envoice

“Adopting Envoice was a game-changer for us at e-Residency Hub. Without it, we would have needed to hire at least twice as many accountants to manage the workload from our 800+ clients worldwide.”

Martin Lään

CEO, e-Residency Hub

The Challenge

“Facing our rapid scale-up, the challenge was immense,” reflects Martin Lään, CEO of e-Residency Hub. “Our goal was to maintain a streamlined and uniform process for handling financial documents, despite catering to clients from over 120 countries.”

As the company grew, the volume of invoices and receipts from clients across the globe increased significantly. Manually processing these documents was not only time-consuming but also monotonous for their skilled accountants, who were better suited for high-level financial analysis and strategic planning.

The need for an effective solution was clear.

Beyond just automating the initial data extraction, e-Residency Hub was looking for a way to make its entire accounting process more efficient. They envisioned a system that could simplify and automate routine processes, ensuring that once the initial data was captured, the subsequent accounting steps, especially for regular and recurring transactions, could be handled with minimal human intervention.

This move towards greater automation was aimed not just at increasing efficiency but also at allowing their team to focus on more valuable and fulfilling aspects of their work.

Envoice’s Solution

“Envoice has revolutionized our workflow, saving countless hours and accelerating document processing by at least 2x, making our operations significantly more efficient,” states Martin.

Envoice, a cloud-based bookkeeping automation tool, has transformed the once laborious task of data entry, streamlining the management of financial documents from a diverse client base.

Clients can conveniently submit their invoices and receipts through various channels, such as email, direct upload, or the Envoice mobile app. Centralized archiving and automated data extraction, facilitated by Envoice’s sophisticated AI technology, bring efficiency and simplicity to the process.

The Impact

The integration of Envoice into e-Residency Hub’s workflow has led to significant streamlining of processes and an enhancement in client service standards. Operational efficiency and client satisfaction have seen marked improvements, aligning with the firm’s commitment to flexible, location-independent services.

This real-life case study shows the practical application of all the benefits of automation mentioned earlier. The business deals with complex structures because its clients are in 120 countries and used ENVOICE in a way that revolutionized their business model.

If they can use an automation tool in such a powerful way, it stands as a testimony to what this technology can do for any accounting firm that is willing to give automation a chance.

One final thing

Imagine a world where CPA firms are no longer bogged down by the tedious and time-consuming tasks of manual bookkeeping. A world where the focus shifts from endless data entry to strategic financial planning and client relationship building. This is not a distant dream but a tangible reality made possible by automation in accounting.

In this article, we’ve provided you with a way to get new clients and stop wasting time and valuable resources. We’ve proposed that it’s not a question of: How many clients does a CPA firm have? But one of: How many clients can you handle with your current practices and processes?

If you want to scale your business without the burden of taking on more employees and spending more time and money, then automation is the answer staring you in the face.

ENVOICE is offering accountants and bookkeepers their automation tool for a very reasonable monthly subscription of $11 a month. With this small investment into automation, you can save your firm thousands of dollars in expenses and walk away with more revenue.

A small CPA firm somewhere in the world (that’s you) has 10 employees and 150 clients and delivers world-class accounting services (also you). Just imagine. Now, take the first step.

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day