The 10 Worst Accounting Scandals In US History

Accounting is one of the most highly regulated industries in the United States. So when accounting scandals occur, they make headlines.

When accountants are dishonest, the consequences are far-reaching. Not just for the companies involved but also for the economy. Some of the biggest accounting scandals have led to disasters, like the infamous 2008 financial crisis.

Here are ten of the worst accounting scandals in US history.

1. Enron scandal

Arguably the most infamous and one of the worst corporate accounting scandals in US history.

Enron’s collapse cost investors billions of dollars and jail time for some of its executives. The energy company’s demise was partly due to its aggressive and complex accounting practices.

One such practice, dubbed “mark-to-market” accounting, allowed Enron to record profits on long-term contracts even though they hadn’t yet been earned. This created the appearance of consistent earnings, essential to Enron’s success in attracting investors.

The company’s CEOs, Ken Lay and the then-current CEO, Jeff Skilling, also hid big debt from their books. If that was not bad enough, they pressured the auditing firm not to report the issue.

When the dot-com bubble burst in 2001 and energy prices fell, Enron’s aggressive accounting practices could no longer hide that the company was in trouble. This led to a rapid decline in Enron’s stock price and its filing of bankruptcy in December of that year.

The end result of Enron’s scandal

- Former CEO Kenneth Lay was convicted on six counts of fraud and conspiracy and four counts of bank fraud.

- Current CEO Jeffrey Skilling was convicted and sentenced to 17.5 years in prison.

- Arthur Andersen, one of the world’s five largest accounting firms at the time, was found guilty of signing off corporate reports despite Enron’s questionable activities.

- Shareholders reportedly lost $74 billion in the four years leading up to bankruptcy.

- Employees lost retirement savings and jobs

- The public lost faith in corporate America

- Enron filed for bankruptcy

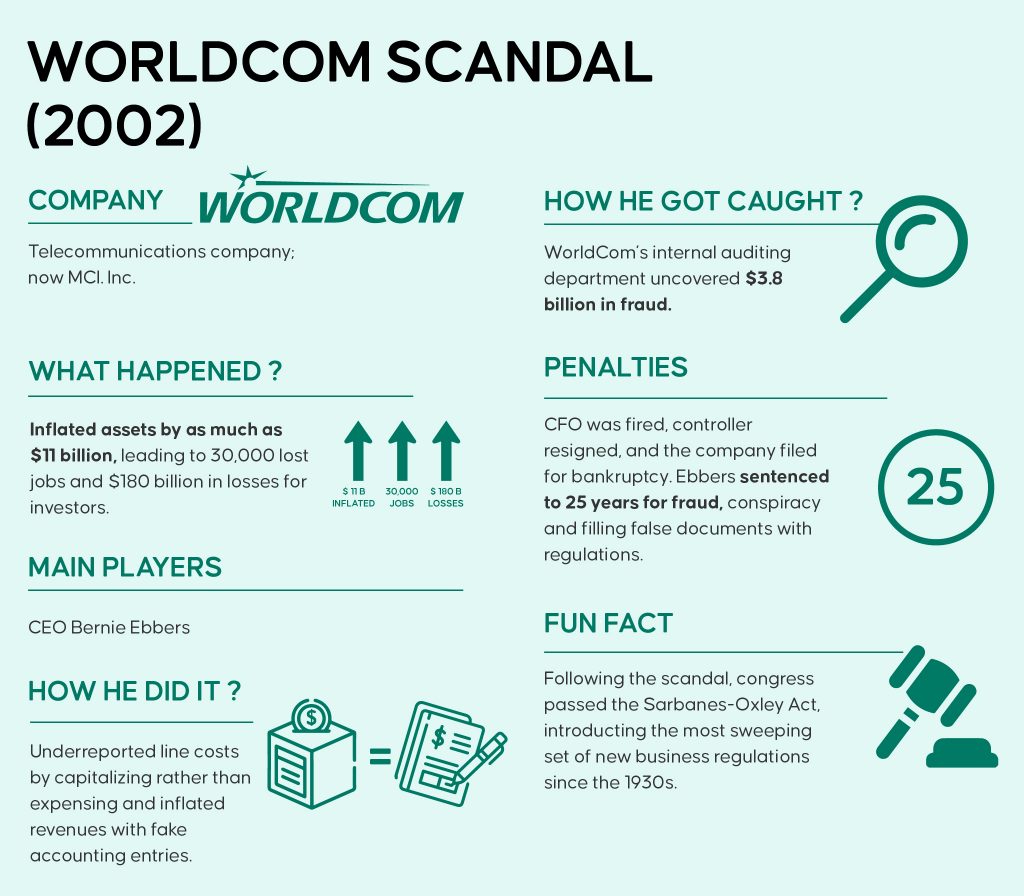

2. WorldCom

The next biggest scandal on the list occurred just a year after Enron. In 2002, telecommunications giant WorldCom admitted improperly accounting for $4 billion in expenses.

Like Enron, WorldCom used aggressive accounting practices to mask its debt and make its earnings look better than they were.

As if that was not bad enough, they added fake entries, which resulted in an increase in revenues.

The company’s CEO, Bernie Ebbers, was the main player and was charged with conspiracy, fraud and falsifying documents. He was imprisoned for 25 years and investors lost as much as $180 billion, making it one of US history’s most expensive accounting scandals.

The end result of WorldCom’s scandal

- Bernie Ebbers lost his fortune and was sentenced to over 25 years

- Former CFO Scott Sullivan received a five-year jail sentence after pleading guilty

- Sarbanes-Oxley Act was passed by congress, bringing a raft of changes to the regulation of financial reporting

- Investors lost $180 billion

- The company filed for bankruptcy

3. General Electric Accounting Scandal

In recent years, General Electric Accounting Scandal has revealed that the company used illegal methods to inflate its earnings and hide losses.

The scandal came to light in 2017 when the Boston-based conglomerate was forced to restate its earnings for 2016 and take a $50 billion charge related to its insurance business.

This accounting scandal was discovered after SEC launched an investigation that revealed that GE used accounting practices that violated generally accepted accounting principles.

GE did not tell investors that as much as 25% of the 2016 GE Power profits were from receivable transactions from its sister company GE Captial. This always included as much as 50% of the profits in the first three-quarters of 2017 due to bad accounting practices.

The CFO Jeffrey Bornstein and then-current CEO Jeff Immelt were threatened by SEC with a civil action, but they have not been charged with criminal charges yet.

The end result of General Electric Co.’s scandal

- The stock price fell by over 75%

- CFO Jeffrey Bornstein left the company

- The company was slapped with a $200 million penalty by SEC for violating anti-fraud, reporting, accounting controls & disclosure controls laws.

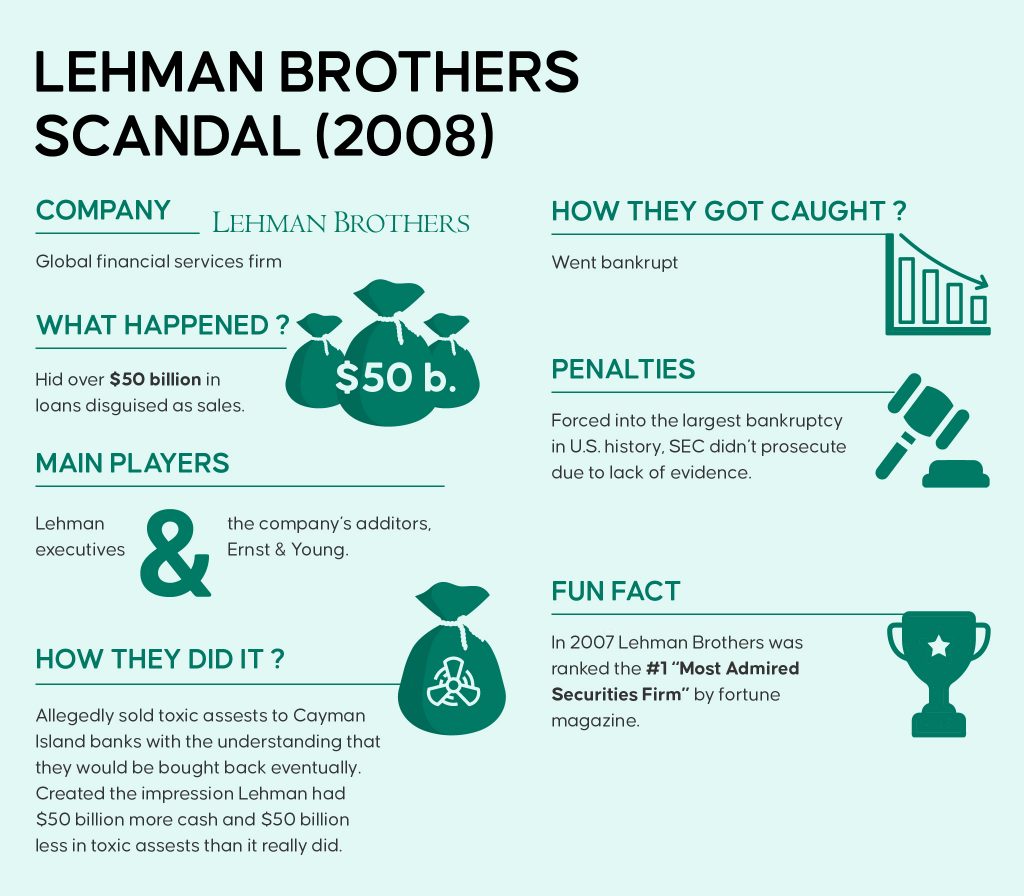

4. Lehman Brothers Scandal

As a leading global financial services provider, Lehman Brothers Holdings Inc. was one of the first companies to be brought down by the subprime mortgage crisis that began in 2007.

On September 15, 2008, the company filed for bankruptcy after it failed to find a buyer or secure additional financing. This filing marked the largest corporate bankruptcy in US history at that time.

With over 25,000 employees, $613 billion in liabilities, and $639 billion in assets, Lehman Brothers was one of the most complex bankruptcies in US history.

The Lehman Brothers scandal is still felt today as many people lost their jobs, retirement savings, and homes. Their $50 billion in loans were hidden and disguised as sales.

They entered an agreement with Cayman Island banks where they agreed to sell toxic assets. But they made an impression that they had 50 billion less toxic assets and $50 billion more cash which forced them into bankruptcy.

The end result of the Lehman Brothers scandal

- The company filed for bankruptcy on September 15, 2008

- No executive was charged due to a lack of evidence

- Thousands lost their jobs, and more lost their savings

- Lehman Brothers company was delisted from the New York Stock Exchange

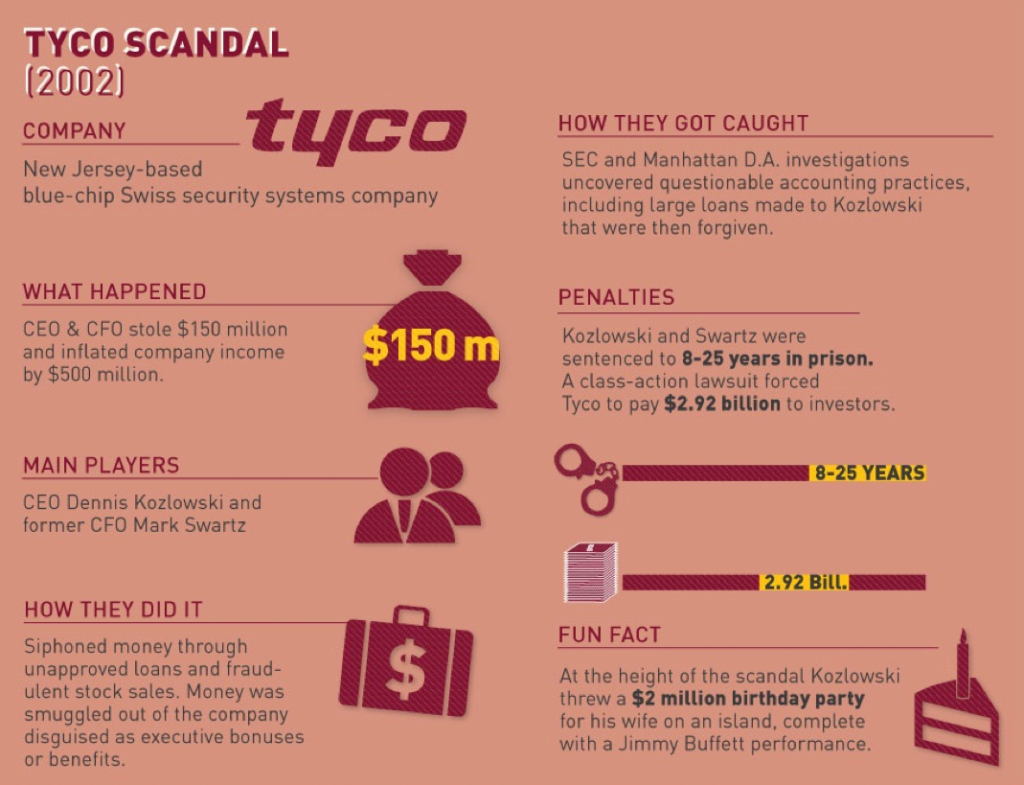

5. Tyco Accounting Scandal

Prior to 2003, Tyco was one of the world’s largest conglomerates with interests in a diverse range of businesses, from security systems to medical supplies.

But in 2002, it was revealed that Tyco’s top executives had been looting the company for years, using corporate funds to finance lavish lifestyles.

Dennis Kozlowski, a former CEO of Tyco, was found guilty of looting the company for $170 million and was sentenced to 25 years in prison. Other top executives, including CFO Mark Swartz, were also found guilty of securities fraud and conspiracy.

PricewaterhouseCoopers also failed to detect the fraud, as they were Tyco’s auditors at the time.

The end result of Tyco’s scandal

- Dennis Kozlowski & Mark Swartz were sentenced to 25 years in prison

- Both Swartz & Kozlowski were also fined $35 million and $70 million and had to pay $134 million in restitution.

- Tyco agreed to pay $26 million to settle SEC & DOJ charges.

6. Bernie Madoff Ponzi Scheme

Bernard Lawrence “Bernie” Madoff was a successful American businessman who ran a multibillion-dollar Ponzi scheme considered the largest financial fraud in US history.

A Ponzi scheme is an investment fraud that pays existing investors with funds from new investors rather than from actual profits earned by the company.

Madoff founded Bernard L. Madoff Investment Securities LLC in 1960 and was its chairman until his arrest on December 11, 2008.

The company was a market maker on the NASDAQ stock exchange, and Bernie had served as the chair of the Market for three years.

At the time of Madoff’s arrest, Madoff Investment Securities LLC managed over 37,011 investors who had invested billions of dollars, making it one of the worst corporate accounting scandals of its time.

His sons turned him in to the authorities when they learned of their father’s scheme. He was found guilty and sentenced to many years in prison.

The end result of Madoff’s scandal

- Madoff was sentenced to 150 years in prison

- He was ordered to pay $170 billion in restitution

- Many people lost their life savings

- Victims repaid $2.7 billion in 2008

- David Friehling and Frank DiPascalli’s accountants were also given prison time.

- Madoff’s sons cooperated with authorities and were not charged criminally. However, they were under criminal investigation until their deaths.

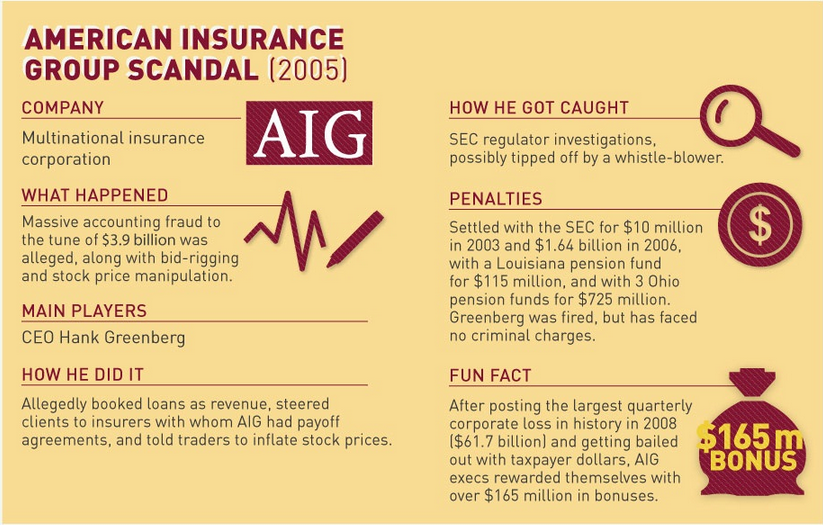

7. American International Group Inc. (AIG) Accounting Scandal

Considered one of the biggest multinational insurance firms, AIG was founded in 1919 and operated in more than 130 countries.

The company became the target of an SEC investigation in 2005 for its questionable accounting practices. The investigation revealed that AIG had been using improper accounting methods to inflate its earnings and hide losses.

AIG was also accused of misleading investors about the risks of selling certain insurance products.

It was also revealed that the then CEO Hank Greenberg would steer clients to other insurers with which they had payoff agreements. On top, they also did bid-rigging & inflated stock prices.

Once SEC began investigations, AIG was forced to settle $30 million in 2003 and $1.64 billion in 2006. Hank Greenberg was also forced to step down as CEO but was never charged. The company also settled with several pension funds for over $800 million.

Interestingly, the company posted the biggest loss of any corporation in history in 2008 ($61.72 billion) and had to be bailed out by the US government. But the executives pocketed a handsome $165 million in bonuses.

The end result of AIG’s scandal

- AIG was fined $30 million in 2003 & $1.64 billion in 2006

- Hank Greenberg was forced to step down as CEO but never charged

- The company posted the biggest loss of any corporation in history and had to be bailed out by the US government.

- Several pension funds were also defrauded by the company but were later reimbursed.

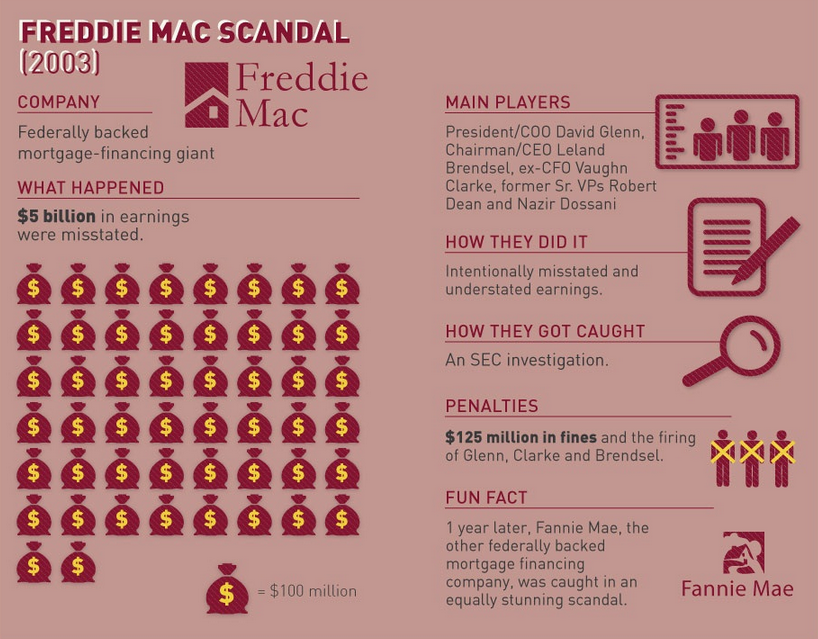

8. Freddie Mac

In 2003, Freddie Mac, one of the largest mortgage lenders in the US, was accused of manipulating its books to meet earnings targets and bonuses for senior executives.

As a federally backed institution, Freddie Mac is required to submit financial statements to the SEC.

An investigation by SEC revealed that Freddie Mac had overstated its earnings by $ five billion.

The report also found that senior executives at Freddie Mac were aware of the accounting manipulation. Some prominent players included COO David Glenn, CEO Leland Brendsel, and CFO Vaughn Clarke.

They understated the earnings by $1.5 billion to $4.5 billion after taxes. This meant that before taxes, the earnings were over $6.9 billion. (1)

In the end, the company was fined $125 million, and the top brass was forced to resign.

The end result of Freddie Mac’s scandal

- Fined $125 million

- Forced several executives to resign

- The company was forced to reform its internal accounting practices.

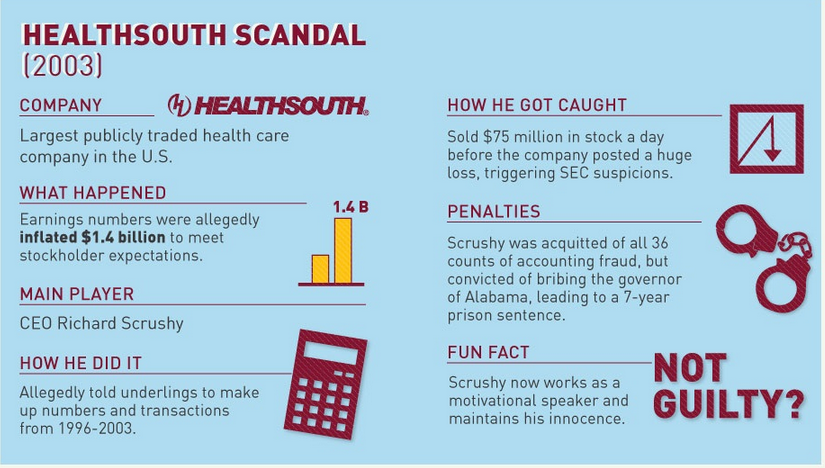

9. Healthsouth Corporation

Healthsouth Corporation is one of the largest healthcare providers in the US.

The company was accused of overstating its earnings by $1.4 billion from 1999 to 2002. The SEC investigations revealed that Healthsouth inflated its earnings through various means such as bogus entries, round-tripping transactions, and false accounting. (2)

The main aim was to meet the expectations of shareholders. As the largest publicly traded healthcare company, it had much to lose if it did not meet the investors’ expectations.

The then CEO Richard Scrushy was accused of masterminding the accounting fraud. He was later acquitted by a jury but convicted of bribery charges, earning him seven years jail term.

The company had to let Scrupsy go & restate its earnings. Interestingly, Scrushy now works as a motivational speaker.

The end result of Healthsouth’s scandal

- Several executives were also charged.

- CEO Richard Scrushy was acquitted of all charges related to the accounting scandal but was later convicted of bribery.

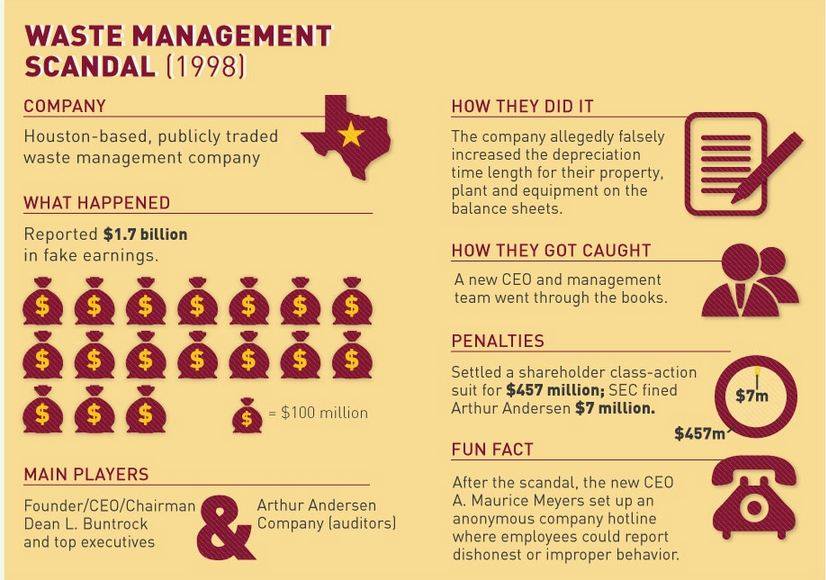

10. Waste Management Company Scandal

At the close of the millennium, the Waste Management Company was at the top of its game.

The company was accused of overstating its earnings by $1.7 billion. This was only discovered after a new CEO, Maurice Meyers, and his team.

They found that Waste Management company had been engaged in several fraudulent financial reporting and practices such as double-billing, misreporting disposal costs & inflating revenue.

The investigations revealed that these practices had been going on for years, and the management was aware of it. Dean L Buntrock, the owner, former CEO, and other senior management team members were indicted.

Waste Management Company had to settle a class-action suit with its shareholders to a tune of $457 million. The shareholder class-action suit was not the end as the Securities and Exchange Commission also fined Arthur Andersen, the auditors, over $7 million.

Together with other top executives, Buntrock was found guilty of accounting fraud.

The end result of Waste Management Company’s scandal

- Settling a class action suit with shareholders for $457 million.

- Arthur Andersen, the auditors, was fined over $7 million.

- The top executives were found guilty of accounting fraud

What are the main causes of accounting scandals?

Throughout history, there have been several high-profile accounting scandals that have rocked the business world. While each scandal is unique, some common themes and causes can be identified.

The most common cause of an accounting scandal is when a company or individual tries to artificially inflate their earnings to meet analyst expectations or boost their stock price.

This can be done through several methods, such as booking false revenue on the financial statements, inflating expenses, or engaging in round-trip transactions.

Another common cause of accounting scandals is when companies try to hide their actual financial situation by cooking the books.

This can be done by hiding expenses, failing to properly record transactions, overstating or understating assets, or using creative accounting techniques to make the numbers look better than they are.

Whatever the cause, accounting scandals can have serious consequences for the companies and individuals involved. In addition to fines and jail time, these scandals can destroy reputations and shareholder value.

If it’s a case of fraudulent stock sales, investors can lose millions of dollars.

The Best Ways to Prevent Corporate Accounting Scandals

Improve internal controls and financial reporting processes

Most accounting scandals that have made headlines in recent years could have been prevented with better internal controls. Internal controls are the procedures and policies a company has to ensure that financial statements are accurate and free from fraud.

By improving internal controls, companies can make it more difficult for employees to engage in fraudulent activities and make it easier to detect any irregularities.

Improve communication between management and the board of directors

Most corporate accounting scandals happen behind the backs of the board of directors.

The board of directors is responsible for overseeing the activities of management and ensuring that they act in the company’s best interests.

However, in many cases, the board of directors is not provided with accurate or timely information about the company’s financial condition. This can make it difficult to identify problems early on and take corrective action.

To help prevent accounting scandals, companies should improve communication between management and the board of directors so that the board is always aware of what is happening within the company.

Put a whistle-blowing policy in place

A whistle-blowing policy is a formal process that allows employees to report any suspected fraudulent or unethical activity. This can effectively prevent accounting scandals, as it gives employees a safe and anonymous way to raise any concerns they may have.

When designing a whistle-blowing policy, companies should ensure that it is easy for employees to understand and that there are no repercussions for those who report suspicious activity.

Use technology

While technology cannot completely prevent accounting scandals, it can make detecting and preventing fraud easier.

For example, companies can use data analytics to identify patterns of fraud or abuse. They can also use software to automate financial reporting and compliance processes.

Establish ethical standards and a culture of honesty

Accounting fraud starts with greed and unethical behavior. To help prevent accounting scandals, companies should ensure that they have strong ethical standards and that their culture encourages employees to act ethically.

Some ways to do this include establishing a code of conduct, providing training on ethics and compliance, and setting up an anonymous hotline for reporting concerns. An ethical culture goes a long way in helping prevent and unearth accounting fraud before it.

Background checks on all executives

Corporate accounting scandals often involve senior executives with access to sensitive information and the ability to make decisions that affect financial statements.

To help prevent these types of scandals, companies should conduct background checks on all executives before hiring them.

These checks should include a review of their financial history and any criminal or civil proceedings that have been filed against them. By conducting background checks, companies can ensure that they are not hiring someone likely to commit fraud.

Better communication with auditors

Fraudulent accounting practices are often only discovered after an audit. To help prevent accounting scandals, companies should better understand the auditing process and what auditors are looking for.

This can be done by communicating with the auditor regularly, reviewing the audit results, and taking action to correct any deficiencies.

Companies can help ensure problems are discovered and corrected before they become the next famous accounting scandal by working closely with the auditor.

Compliance with the set laws

After the many corporate accounting scandals of the early 2000s, the government put new laws and regulations to help prevent future scandals. The most notable of these is the Sarbanes-Oxley Act, which imposes stricter requirements on financial reporting.

Companies should ensure that they comply with all applicable laws and regulations, as this can help prevent accounting fraud. In addition, companies should have policies that help detect frauds like financial statement fraud & stock price manipulation on their tracks.

Further Reading:

- How to prevent fraud in Accounting

- Will Accounting be fully automated in the future?

- How to Build a Next-Generation Accounting Firm: The Future of the Industry

Article Sources:

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day