How to Forecast Accounts Receivable for Small Business

Forecasting is a valuable skill that allows small businesses to make informed decisions. However, it may not feel like a priority, with so many other things to consider.

Forecasting accounts can incorrectly be thought of solely as an accounts function. It is, in fact, in the best interest of all small business owners to stay on top of their cash flow.

Learning to forecast accounts receivable does not have to be stressful. With a small amount of knowledge and consistent practice, this skill can become invaluable and a game-changer for small businesses.

Accounts receivable in a nutshell

Accounts Receivable (AR) is money due for goods and services the company has provided but has yet to receive payment for. This has a net effect on funds available to manage operating expenses in the business.

On the balance sheet, accounts receivable is an asset. A decrease in accounts receivable means an increase in cash.

What is an accounts receivable forecast?

If the process of understanding collections and how much cash will be available to the business over time. It is also a model that is used to predict future payments that will be made to the company.

Factors that could affect accounts receivable

According to a survey of small businesses in 2021: [1]

39% of all invoices are not paid on time in the United States

48% of customers will delay making payments until the last moment

61% of invoices are paid late due to incorrect information

These numbers make a huge impact on the cash flow of small businesses. Some easy, proactive measures, such as payment reminders and accurate invoices, can aid accounts receivable forecasting.

What makes accounts receivable forecasting difficult?

The reason forecasting is difficult is that action is required by the customer. Payment terms are agreed upon upfront, but it is still in the hands of the customer to pay on or before the due date.

A business cannot predict the exact date on which payment will be made. It can only predict the maximum number of days a balance will be outstanding.

This creates a high level of unpredictability regarding accounts receivable forecasting. Not exactly a comfort to most small business owners.

Forecasting for a period of two to four weeks can be quite accurate. Longer periods introduce many variables, such as invoice volumes, payment turnaround times and economic factors beyond the business’s control.

However, it’s still highly beneficial to do simple calculations that will help you understand where your business’s vulnerabilities lie.

Importance of a sales forecast in accounts receivables

The forecasting process begins by looking at possible sales over a period of time, a month or a quarter. Use historical data such as monthly sales, number of new customers, number of active customers and sales targets achieved.

Customer Relationship Management (CRM) software can assist you to draw reports for sales forecasting. For a small business, a basic free CRM service, such as that provided by HubSpot [2], can be invaluable.

Envoice ingrates with CRM systems and small business accounting software seamlessly, providing you with powerful data at your fingertips.

– Short-term forecasting of sales – helpful formulas

Financial modeling ties accounts receivable to revenue since they are closely related. The SalesHacker site provides useful formulas for predicting sales [3]. Let’s look at this example based on historical data.

Example:

Monthly Recurring Revenue (MRR) $150 000

% growth of sales monthly (12 months) 12%

Monthly Churn % 1%

($150,000 * 1.12) – ($150,000 * .01) = $166,500

Sales revenue figures tell a story of their own regarding cash flow management. Not only will they help you to predict accounts receivable, but they provide valuable information when considering your accounts payable data. These two variables tell a business how much cash will be available.

Forecasting accounts receivable using days sales outstanding (DSO)

The formula is as follows:

DSO = (Accounts receivable/Revenue) x Number of days

The projected Accounts Receivable Balance is then equal to:

Projected Accounts Receivable = [DSO/365] x Revenue

– Example:

A company that re-sells compounded medication has net credit sales of $100 000 and for a period of 50 days, the accounts receivable is $60 000

DSO = (Accounts Receivable / Revenue) x Number of Days

= (60000/100000) x 50

= 30 Days

Thus, this company anticipates recovering its collections in 30 days. Generally, a DSO of less than 45 days means that the company will have a consistent cash flow.

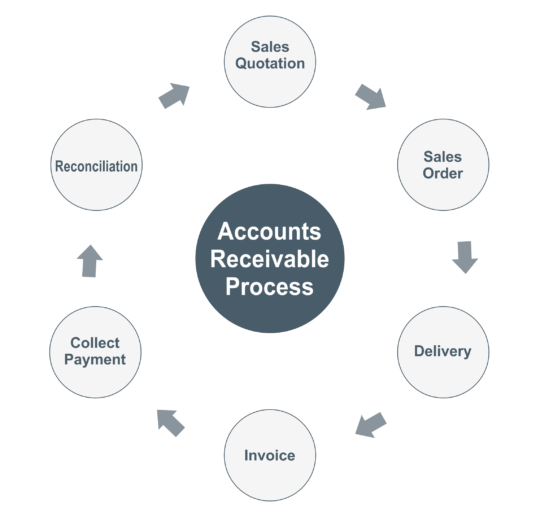

How can I calculate the AR cycle?

The accounts receivable cycle begins when goods or services have been delivered but the invoice still needs to be paid. It ends when the invoice has been fully settled.

The aim of this cycle is to manage the amount of money coming into the business on a consistent basis.

The cycle is based on the number of days it takes to settle invoices fully. The average payment period is 30 days for small businesses.

Investopedia provides the following definition:

‘The average collection period is calculated by dividing a company’s average accounts receivable balance by its net credit sales for a specific period, then multiplying the quotient by 365 days’ [4]

The benefit of Accounts Receivable Automation in forecasting

The data integrity with automation is much higher than with manual processes. Human error is substantially reduced and instead, data tracking is done by the software.

The automation process assists with the collections process by notifications of payments due and automatic reminders sent out to customers.

Since invoices are produced from populated information and sent directly to the customer in electronic format, the chances of invoices not being paid on time are minimized.

Customized reports can be set up to collect forecasting information, greatly increasing the efficiency of the process.

Envoice integrates with your accounting software to fully automate the extraction of data from invoices and other documents, providing accurate and real-time data.

Conclusion

As a small business owner, you want as much control as possible over the cash that flows in and out of your business.

One bad payer can negatively affect the financial viability of your business. The entire aim of forecasting is to provide you with the means to prevent or mitigate this.

Even if you do not have an automated process, you can still benefit from simple accounts receivable calculations. This information puts the power back in your hands as a small business owner – exactly where it should be.

Further Reading: The 7 Best Practices in Accounting That You Should Be Aware Of

Footnotes:

[1] https://about.gosite.com/blog/accounts-receivable-statistics

[3] https://www.saleshacker.com/sales-forecasting-101/

[4] https://www.investopedia.com/terms/a/average_collection_period.asp

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day