OCR in Accounting – How to Achieve Major Time Savings

Have you ever wondered how PDF-to-text converters allow you to edit a document in a Word file? Did you feel amazed how taking a photo of your ID card saves you from filling out a form requiring your personal information while opening an online bank account?

Both processes feel magical, but rather than sorcery, you have to thank a technology called optical character recognition or OCR.

OCR is behind many document processing applications from passport verification technologies in airports to smartphone apps that can translate foreign signs and food packaging labels to another language.

Companies across all industries use OCR technology in various ways, but according to a report by Researchdive, banking, financial services, and insurance hold the largest market for OCR. [1]

Given the convenience of using OCR, accounting, a field notorious for lengthy data entry tasks, is seeing significant changes as user-friendly OCR technology becomes available in the market.

But what exactly is OCR, and how is it revolutionizing the accounting industry?

What is OCR?

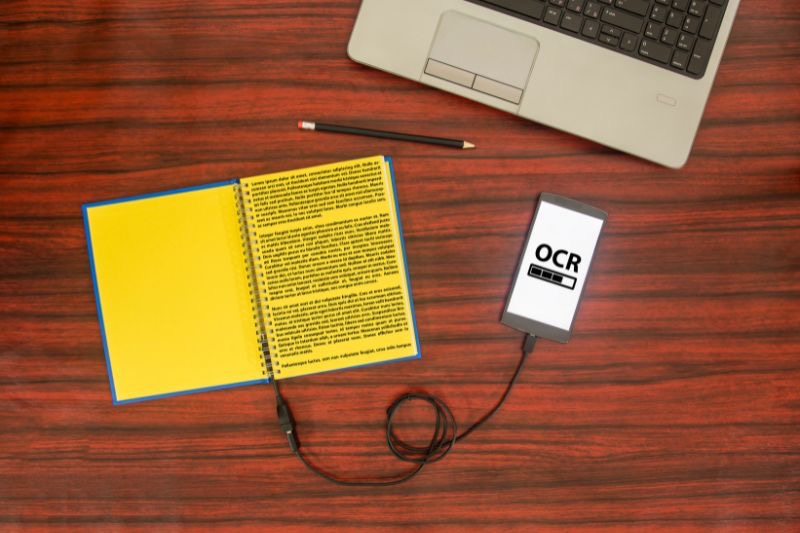

Optical Character Recognition converts data from an image into machine-readable text. With OCR software, you can convert a photo or a scanned document into editable text – saving you from encoding information manually.

Who Developed OCR Technology?

OCR is one of the earliest forms of AI, and it relies on recognizing patterns and features to identify letters, numbers, and symbols.

With OCR, the once impossible dream of having paperless offices is now becoming a reality.

However, the inspiration for modern OCR technology can be traced back to 1914 with the introduction of the Optophone, an instrument that allows blind people to “read by ear.” [2]

It took another 60 years for Ray Kurzweil to invent the modern optical character recognition computer program. Kurzweil eventually sold the technology to Xerox, and the company commercialized paper-to-computer text conversion.

OCR technology became available to internet users a few decades later. However, scanning data with early OCR technology resulted in inaccurate and poorly formatted scans. Many of the free PDF-to-text converters today continue to have this problem.

Modern Optical Character Recognition Tools

Developments in OCR software have come a long way since it became available in the 2000s. Modern technology addressed the issues with accuracy and created a more advanced version of this tool that recognizes handwriting.

As OCR became more commercially viable, more companies started offering products with OCR features for document processing.

Here are some tools that you may have used yourself.

- Adobe Acrobat Pro DC – The paid version of Adobe Acrobat comes with many features, including OCR basics that allow you to edit scanned documents.

- OmniPage Ultimate – When it comes to OCR for business use, OmniPage Ultimate is a trusted name due to its accuracy and comprehensive features, but it is a bit expensive.

- Abby – Abby is an OCR brand with subscription packages designed for different users.

Many companies use OCR for archiving, but niche applications have emerged especially in finance and accounting. For instance, many companies use OCR solutions to extract data from financial documents.

Overcoming Accounting Pain Points With OCR

Accounting is all about documenting where the money goes. You need to enter information from receipts, invoices, purchase orders, and other supporting documents into accounting software.

Accounting firms and departments cannot move forward with preparing financial reports without this information.

Due to the sheer volume of information that requires manual keying, many accounting professionals perform more clerical tasks than analytical work.

While time spent on entering data varies from one company to another, a study finds that 92% of employees spend about 8 hours every week finding information needed to serve customers. [3]

OCR technology eliminates the need for employees to key data manually.

Here’s how utilizing OCR technology changes how bookkeepers work:

- Employees receive paper documents, emails, PDFs, or other source materials to scan.

- OCR software processes the scanned image and converts it to your required format using predefined rules.

- Data extracted becomes available for review or editing.

OCR Applications for Different Accounting Functions

There is no shortage of OCR applications in different fields of accounting either.

In Accounts Payable, OCR technology can automatically invoice data from thousands of vendor invoices.

Accounts Receivable departments automatically scan invoices to speed up the processing of customer payments. Even the Internal Audit function benefits from improved automatic matching, making it easier to detect potential red flags.

With computers taking over the most time-consuming process – entering data – your team can focus on verification, review, and interpreting trends.

As accounting teams realize how OCR improves productivity, more companies are willing to try using technology with AI capabilities.

OCR Technology Goes Mainstream

Automation which used to be a “nice to have” is now becoming a necessity.

A survey by Deloitte revealed that 50% of businesses implement OCR technology which is second only to Robotic Process Automation or RPA. [4]

In the next three years, 27% plan to use OCR software. Cost reduction is the primary motivation for investing in this technology. On average, companies achieve a 31% cost reduction through intelligent automation.

Companies look to automation tools like OCR to reduce cost pressure. Going digital is a strategic move with the global economic turmoil and rising prices.

With technology, companies become more efficient and effective, which reduces operating costs. Aside from supporting growth and profitability, using OCR technology also leads to higher productivity, frees up employee time, and improves employee engagement.

Buying More Bandwidth for Your Accounting Team

Optical character recognition is changing what accounting professionals do. As machines take care of the monotonous processes, accounting departments can finally focus on value-added tasks.

As a result, employees achieve better work/life balance while improving their quality of work.

How exactly does OCR make this happen?

Eliminates Time Spent on Manual Data Entry

OCR saves accounting teams from manually keying information from receipts, account statements, and invoices.

On average, an employee may spend 3 minutes on one document. If a company processes 1,000 invoices in a month, employees spend 3,000 minutes or 50 hours on data entry alone.

If employees get paid $20 an hour, the company incurs a monthly expense of about $1,000 for highly qualified accounting professionals to enter data.

Small companies with only a few transactions may not have problems keeping up with encoding data. But as businesses grow, relying on employees to enter data manually is not sustainable or cost-effective.

According to a PWC report, companies using even the most basic data extraction AI tools will spend 40% fewer hours performing routine paperwork. [5]

With the time saved from eliminating manual data entry, your employees can focus on tasks that require analytical skills.

Less Time Spent Correcting Errors

Manual data entry requires a keen eye for detail to avoid mistakes. Missing one number or interchanging numbers has a significant effect on business reports.

Unfortunately, human error is impossible to avoid, and the typical error rate due to manual data entry is 1%.

Aside from requiring additional work to correct data, mistakes are also more expensive to fix.

According to the 1-10-100 rule, spending $1 to prevent errors saves $10 for correcting the error and $100 on failure costs.

Investing in optical character recognition reduces error rates on financial information. AI techniques can identify specific fields like supplier, cost, and quantity in different invoices.

Taking humans out of the process improves accuracy by eliminating human error.

At the same time, OCR cuts down time spent on exceptions when combined with other AI tools. Machine learning and RPA can flag values outside the acceptable range. As a result, human reviewers only need to look at these invoices instead of all invoices.

Let’s assume that each month, a company needs to process 500 invoices. In a manual environment, an employee has to enter and review data for all 500 invoices. If 50 invoices have discrepancies, your staff needs to search for supporting documents to verify the details. Using OCR combined with other AI tools, your accounting staff only needs to review those 50 invoices with exceptions.

Enables Analytics

Organizations gather a lot of data for analytics. Unfortunately, many organizations lack the resources to process information into a usable format that computers can understand.

Information gathered comes in different formats, and employees do not have time to spare for converting data into the standard format.

Using OCR with other automation tools is the key to unlocking value from stockpiled data.

With modern tools like OCR, companies can reduce the time required to convert data from spreadsheets, images, and PDFs to structured text by 30 to 50%. [6] Typically, the accuracy of OCR improves as it learns to refine data sets.

By breaking down the barriers to implementing analytics, companies improve efficiency by 30 to 40% – which eventually leads to more time savings and better decision making.

Provides a Better Audit Trail

Gathering evidence and verifying transactions are essential in accounting.

Having digital archives makes it easier to retrieve copies of supporting documents. Since digital copies are available, your employees wouldn’t have to waste time digging for files in your storage space.

They can find information in minutes using the search function. By digitizing documents, you can also reduce costs by eliminating the need for physical storage space.

Cuts Down Duplicative Work

How many times do employees input the same data on different types of software? In many companies, employees have to update multiple systems using the same information.

OCR could be the answer to eliminating duplicative work that wastes hours of employee time.

Companies can integrate OCR products with an accounting system like Quickbooks or Xero to use data extracted through OCR for financial reports. Many Robotic Process Automation tools also use OCR as the starting point of the process.

OCR takes care of data extraction to present information in a format that RPA bots can understand. When data is ready, RPA can take over the process and input information automatically into any software, including legacy systems.

Paving the Way to Automating Accounting Functions

OCR improves several processes and opens many possibilities for automation within an organization. As more companies see the benefits of deploying tools like OCR for higher efficiency, resistance to using technology is also decreasing.

A survey revealed that 72% of employees are willing to use no-code and user-friendly AI solutions that understand the content and context of documents to decrease accounting errors on financial documents and improve efficiency. [7]

In finance, reluctance to use AI tools is declining as well.

Today, companies willing to use OCR and AI are enjoying the convenience of having a better document management strategy.

At the same time, the ability to convert data into structured text makes it easier for businesses to automate more processes and make use of more cloud computing systems.

Smarter Invoice Processing Solutions with Intelligent Data Capture

Aside from being more accurate, modern versions of OCR technology are cloud-based and AI-powered.

Combining AI and OCR allows users to train the software to process relevant data like real people to achieve a higher level of automation.

Another advantage of cloud-based OCR solutions lies in setting up the system. It only takes a short time to set up OCR tools. Thanks to the user-friendly interface of most OCR tools, employees can learn how to use the technology in minutes.

How does that play out in real life?

Here’s how OCR transforms allows companies to access smarter invoice processing solutions.

OCR for Automated Invoice Processing

Typically, companies require employees who travel for work to document their expenses and submit physical expense documents or email reports for audit purposes or to request a refund.

Employees who prepare this report use a template and manually type information based on their invoice. The completed report would then go to a superior for approval.

Now, let’s take a look at a system that uses OCR by exploring Envoice, a smart expense management app.

Envoice has a smartphone app that employees can use on the go, but they can also access the system through their web browser. For this example, assume that the employee uses the smartphone app version.

- An employee who pays for meals for a business meeting opens the Envoice app and snaps a photo of the receipt.

- Using OCR, the app automatically fills out different fields with information such as the restaurant, date, and total bill, so the employee doesn’t have to key information manually.

- The employee reviews additional fields required, like purpose or the expense category for the receipt.

- After reviewing the information, the employee sends the expense for approval.

With Envoice, employees are free from the cumbersome and tedious steps of preparing expense reports.

Since the employee already uploaded a digital copy of the invoice, submitting physical copies of the documents or sending emails with the approval request for invoice processing is no longer needed.

The accounting department will also have more control over expenses since they can see and track all expenses submitted through the app.

Even if the employee forgets to tell the accounting department about the expense sent through Envoice, the department already knows since the request will appear on their workflow.

By providing a convenient way to submit expense reports, lost receipts will no longer be a problem. The comprehensive archiving feature also makes it easier to safeguard documents for future audits or reviews.

However, it’s worth noting that cloud-based products like Envoice don’t rely on OCR alone. The process uses a combination of cloud computing, machine learning, and other automation tools to cut down manual processes and automate repetitive steps like categorizing expenses.

How Does OCR Fit Into Your Digital Strategy?

While achieving 99% accuracy in character recognition is now possible, OCR remains to be an older technology with basic functions. However, an effective OCR tool is essential since this technology sets the foundation for greater automation.

Companies have to use OCR with other technologies like machine learning and Robotic Process Automation to decipher key data found on documents like an invoice and to enable functions like cross-validation or adding numbers.

Unlocking real value from OCR software is only possible when this technology is part of a workflow automation tool that enables automation. Integrating data extracted using OCR with AI-powered systems creates an opportunity for greater automation, enables straight-through invoice processing, and automates compliance and fraud detection.

OCR technology has transformed how businesses handle repetitive data extraction and manipulation. Accounting firms and departments can save hundreds of hours as OCR takes over data entry.

While the application of OCR technology will vary for each company, using this tool with the right strategy in mind leads to time and cost savings as well as operational and strategic gains.

Unlock the Value of Intelligent Data Capture with Envoice

Like any new technology, companies should try optical character recognition tools to see how it fits into existing systems and integrates with accounting software.

Check out cloud-based products that allow instant implementation of OCR, machine learning, and other AI tools that could improve efficiency for your accounting team.

Sign up for a free Envoice trial today to experience a less time-consuming way to manage expenses and invoice documentation.

[1]https://www.researchdive.com/297/optical-character-recognition-ocr-market

[2] https://www.nature.com/articles/105295a0

[3]https://www.abbyy.com/company/news/

[6]https://www.pwc.com/us/en/industries/financial-services/library/analytics-and-automation.html

[7]https://www.abbyy.com/company/news/

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day