The Best Paperless Accounting Software Options on the Market

Welcome to our guide for navigating the best paperless accounting software on the market.

Spending hundreds of dollars and hours of effort on converting to a paperless office only to discover that you’ve chosen the wrong software is a frustration you don’t need. So we want to help you choose an affordable, reliable, easy-to-use paperless accounting system that supports your business processes.

We cover a range of options, from affordable paperless software to premium packages.

We will look at the following:

- The top 7 paperless accounting software options, and

- How to choose the one that’s right for your business

Let’s get started, shall we?

The Top 7 Paperless Accounting Software Options

-

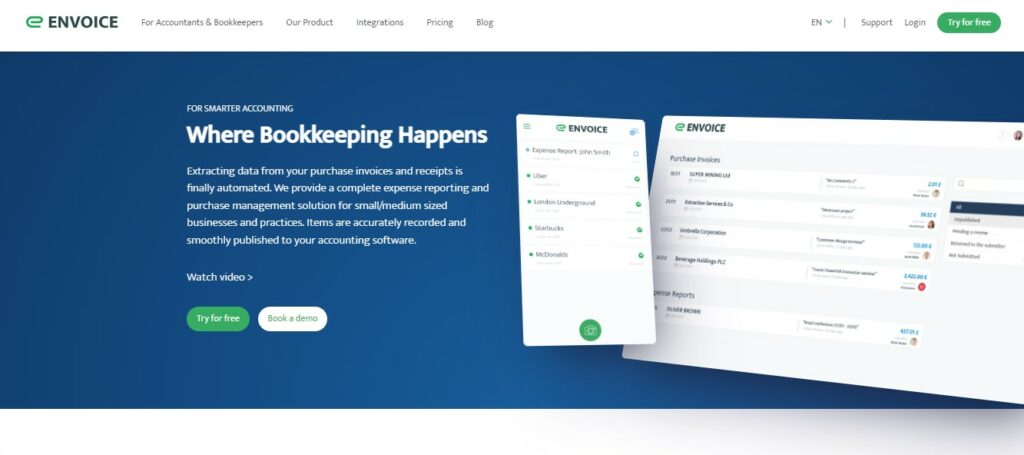

Envoice

Envoice is an expense management platform that helps accounting firms and small businesses streamline their business processes.

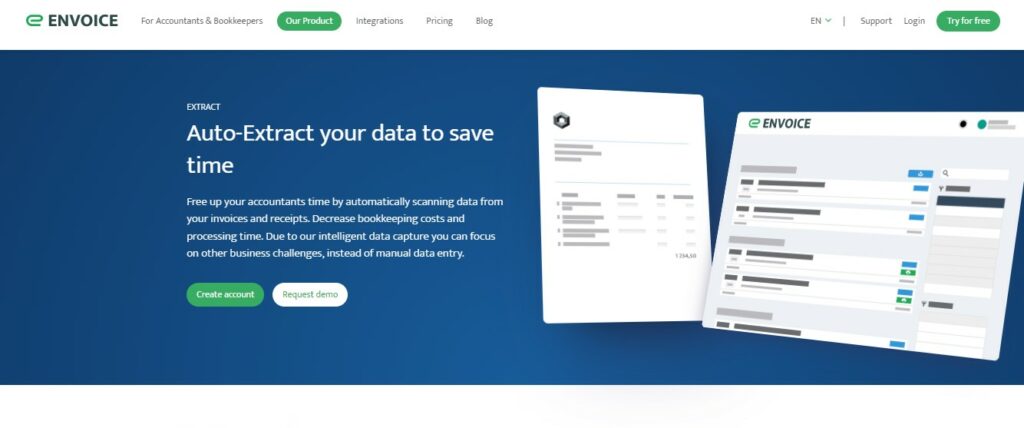

They use artificial intelligence to extract data from paper documents like invoices and receipts. The platform stands out for this reason with its clients, who rate Envoice data extraction superior to similar platforms. [1]

The ExactExtract feature promises 99.9% data accuracy – an exceptional industry standard and one that puts all your auditing fears to rest.

Once extracted, data is moved seamlessly into your accounting software and categorized according to set data rules. This saves tremendous time and effort because you don’t have to import information manually.

With over 20 software integrations and growing, you can use Envoice as the central integration tool for your other software without effort.

As far as a paperless system goes, Envoice stands out for its ability to allow snaps of receipts and invoices to be taken and stored as digital documents. The quality of the images is high for the same reason as its superior data extraction – artificial intelligence and OCR.

There is no need for additional scanning equipment because you can take the images with your smartphone.

If this is all that could be said about Envoice, it would be enough, but they also offer the ability to generate sales invoices and manage all your expenses in one place.

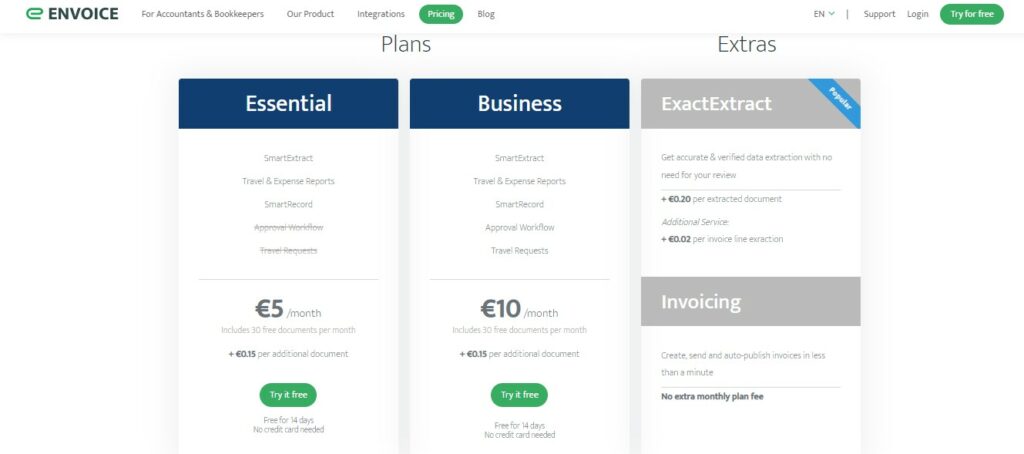

There are two plans on offer – this keeps things very simple. You can add ExactExtract to your plan for data validation.

As you can see from the images, the user interface is neat, streamlined and easy to navigate. They’ve taken all the effort on themselves, leaving you with all the benefits.

Try the software for 14 days free. During this time, you can see for yourself whether it’s just hype or actually delivers. What’s impressive are the emails you receive during this trial – Envoice educates you on improving your processes and offers to interact with you on your personal challenges!

-

QuickBooks Online

QuickBooks Online is a widely used accounting software and with good reason. Here are some stand-out features:

QuickBooks have subscription plans that cover a range of budgets and needs—starting at $30 a month for a basic plan and ending at $100 a month for the advanced plan that provides a full-fledged paperless accounting system with reporting and analytics.

Self-employed plans are best for those with a freelance or side business, while the Simple Start plan is best for companies with only a few employees. The Essentials or Plus plan will be better if you have a medium-sized business. And finally, the Advanced plan is best suited for businesses with more complex bookkeeping needs.

For each plan, you can expect free support, unlimited invoices, tracking of income and expenses, automatic bank syncing, and more.

It is a cloud-based accounting software. This means that users can access their QuickBooks data from any device with an internet connection. QuickBooks Online also offers automation features that can save users much time on bookkeeping tasks.

The software is packed with features that make a paperless office a reality and offers a 30-day free trial, so you can try it before committing to a subscription.

Or, you can contact a QuickBooks expert to help you choose the right business plan.

-

FreshBooks

As small business accounting software, it covers all the basics and more with time tracking, invoicing, online payments, and even managing expenses.

But what sets it apart is that it’s designed to be used by service businesses – think contractors, designers, consultants, etc. This means its features are laser-focused on making these businesses more efficient.

For example, the time tracking feature is designed to make it easy to track billable hours, so you can get paid for every minute you work. And the Freshbooks mobile app makes it possible to invoice on the go to get paid faster.

The third-party integration capabilities make the software even more powerful. For example, you can connect Freshbooks to your Stripe account to take online payments or your Google Calendar to keep track of your schedule.

Pricing for FreshBooks starts at $17 per month for the Lite plan. The Plus plan, which includes everything in the Lite plan plus more features and support, is $30 monthly.

The highest is the Premium plan which costs about $55/month. Do none of these packages meet your needs? Try the Custom Pricing plan, which allows you to dictate what you want and how much you will pay.

For businesses that are looking for an easy-to-use accounting solution that’s designed specifically for service businesses, Freshbooks is a great option. Its focus on simplicity and efficiency can help you save time and money – and maybe even a few trees.

-

Sage Business Cloud Accounting

From its intuitive nature to its many features, this accounting software is designed for businesses of all shapes and sizes.

The software includes invoicing, expense tracking, bank reconciliation, and more. And it can be integrated with various other business software to manage all your business needs in one place.

For instance, Sage helps businesses generate and send invoices automatically. Small business owners can customize customer statements to include a personalized quote or message.

You can also integrate Sage Business Cloud Accounting with your bank account to streamline your cash flow needs. That, plus the AutoEntry feature, expenses are automatically processed and recorded.

Additionally, the software offers a customizable dashboard that gives you an overview of your business’ finances. From there, you can see what you owe, who you owe, and your overall profit and loss.

For the Start plan, pricing for Sage Business Cloud Accounting starts at $10 per month. The Small Business Accounting plan costs around $25. Currently, Sage is offering 70% of their plans for 6 months.

Sage Business Cloud Accounting is an excellent option for businesses looking for an accounting solution with more than just bells and whistles. Its many features and integrations can help you save time and money.

-

Xero

Xero offers all the basics that small businesses need in accounting software – and more. In addition to invoicing, tracking income and expenses, and managing bills, Xero offers payroll, time tracking, inventory management, and project management.

The software is designed to be easy to use, even for those without accounting experience. And it’s cloud-based so you can access it from anywhere.

Xero also offers a variety of integrations that make it even more powerful. For example, you can connect Xero to your bank account to import transactions automatically. Or you can connect it to your eCommerce platform to sync inventory levels and manage orders.

Plus, you can store all the contact information for all your vendors, suppliers, and customers in one place.

Pricing for Xero starts at $25 per month for the Starter plan, which includes, among others, a short-term cash flow and business snapshot.

The Standard plan costs $40/month and includes everything in the early plan plus more features like bulk reconciles transactions.

For $54 a month, you get the Premium plan that gives you all the features in the growing business plan plus access to advanced reporting.

-

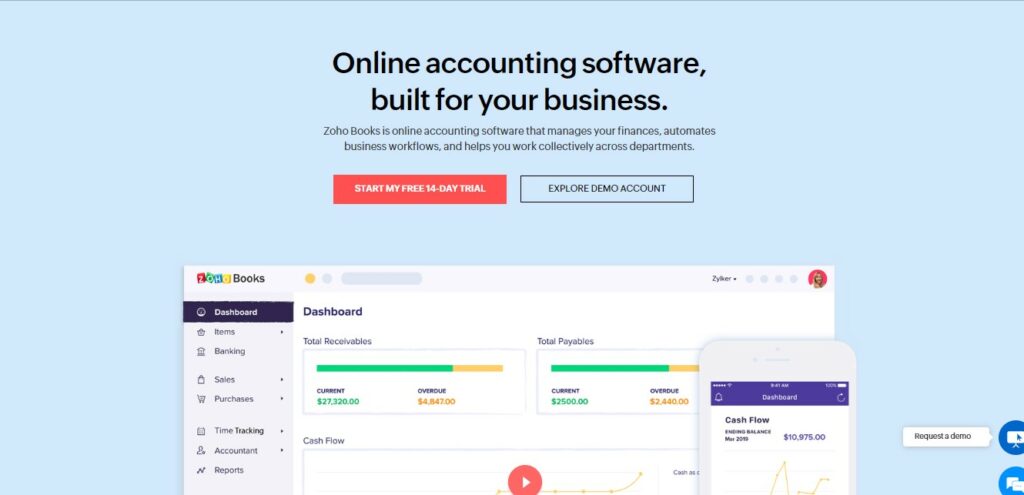

Zoho Books

The cloud-based software makes it easy to generate professional estimates & custom invoices that can be sent directly to suppliers and clients.

And with integrated payment processing, organizations can even allow customers to pay their invoices directly and securely.

Best of all, Zoho Books is entirely paperless, so you can say goodbye to paper clutter for good! Having everything go paperless, from paperless expense reporting to paperless financial statements, means an accounting firm can ace its document management system.

But perhaps the most notable feature of Zoho Books is the client portal. This feature allows organizations to give clients an unlimited view of their financial information.

This way, businesses can provide their clients with transparency and peace of mind, knowing they’re always up-to-date on the latest invoices and payments.

Zoho Books has a wide range of plans, with a free plan for businesses with under 50K USD annual revenue. The paid plans start at $15 per month and end at $240 per month, offering full accounting functions and including advanced analytics. Suitable for large accounting organizations.

-

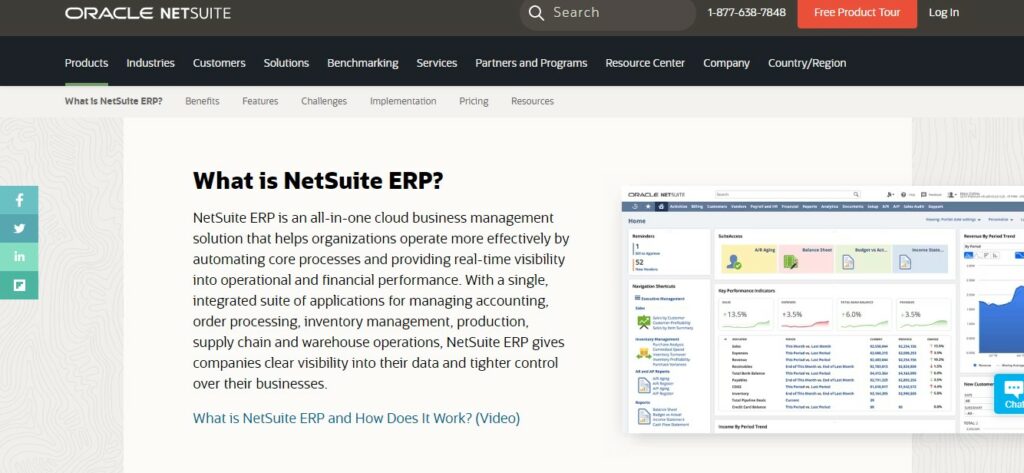

Oracle NetSuite ERP

Oracle NetSuite is a cloud accounting software curated for medium and expanding businesses. The software has all the features businesses need to automate their back-office processes and financial management.

The main selling point of NetSuite ERP is that it’s an all-in-one solution. This means businesses can manage all their core operations in one place – from finances and accounting to inventory and order management.

NetSuite ERP is preferred because its scalability allows businesses to start small and expand the software as their business grows. The software is also highly customizable so companies can tailor it to their needs.

Businesses do not need to look for a complementary tool or program to supplement NetSuite.

Plus, the program allows small business owners to automate most of their back-office processes, giving them more time to focus on growth. Your data is safely stored and can only be accessed by authorized personnel. Since it is cloud-based, the program creates a paperless environment, as all existing paperwork is stored in electronic documents.

NetSuite packages are based on several users, core platforms, and optional modules. Plus, users must pay an initial start-up fee, after which they enjoy the full software benefits. Hence, businesses get to pay only for the services they use.

What to Look for in Paperless Accounting Software

Choosing the right software isn’t as simple as finding the market’s cheapest or most feature-packed option. Instead, businesses must carefully consider their specific needs and find tailored software.

To help you make the right decision, we’ve compiled a list of the most critical factors to look for in paperless accounting software:

Ease of use

The main reason why a business owner is going for paperless accounting software is to save time. This means that the software should be easy to use and shouldn’t require a lot of training to get started.

Ideally, the software should have an intuitive interface that’s easy to navigate. And should have built-in tutorials or a detailed FAQ section to help users get started quickly.

Pricing

Paperless accounting software can range in price from free to hundreds of dollars per month. Of course, the price will largely depend on the software’s features and functionality.

But businesses should also remember that the cheapest option isn’t always the best. In fact, cheaper accounting software might come with hidden costs, such as a lack of customer support or limited storage space.

Features

List the features you want and find a program that offers them. Some software might only offer basic features like invoicing and expense tracking, and that’s perfect if that’s what you need help with.

Others might need more advanced features, such as inventory management or project management. Or that the software can be accessed through a mobile device.

Ideally, businesses should find software with all the features they need. This way, they won’t have to waste time and money on complementary programs or plugins.

Security

Since accounting deals with sensitive financial data, the software must have robust security features.

The software should use encrypted connections, have password protection, and offer 2-factor authentication. Plus, it should give users granular control over who can access which data. Having electronic signatures thus becomes mandatory for the system. By doing so, businesses can be assured that their data is safe from cybercriminals.

Customer support

Even the best accounting software can have its fair share of bugs and glitches. This is why the software must come with excellent customer support.

Software should offer 24/7 customer support so businesses can get help immediately when problems arise. Preferably, customer support should be responsive, knowledgeable, and able to help businesses resolve any issues quickly.

For more information on going paperless, why not check out these articles:

Conclusion

If you’re trying to run a paperless accounting firm or have a small business wanting to use technology to move to digital documents, our recommendation is Envoice.

When you get down to the nitty-gritty of seamless integration, data extraction, the accuracy of data extraction, document storage and use of set-up – Envoice has understood what it takes to build a platform that stands the test of time.

The reviews across the web show that their customers have been with them for many years and are still growing with the company. I like that they answered every review, even the negative ones, with a promise to do better. Looking at the older reviews, it appears they kept their promise. I can live with that.

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day