AP Scanning Solutions: How they can add value to your business

Accounts payable is not longer just about paying bills – it’s about managing relationships, optimizing cash flow, and freeing up your team for higher-impact work. AP scanning solutions aren’t just the latest tech upgrade – they are a strategic move to transform the way your business handles invoices.

We explore the value of adding them to your business, using real-life use cases and a spotlight on Envoice, a rising leader in this arena.

Why AP Scanning Solutions Matter More Than Ever

Finance teams today are under pressure to do more with less. Manual AP processes (once the gold standard for invoicing processing) have become an antiquated business strategy, slowing everything down. Not only is manual AP processing not faster, but it’s prone to errors and creates bottlenecks that negatively affect vendor relationships.

Automated invoice scanning, on the other hand, is busy revolutionizing the AP process, much like the industrial revolution changed the face of consumerism, when it introduced mass production and rapid economic growth.

We did some digging into what the internet has to say about the advancement of invoice scanning software, and found the following interesting claims:

- Manual data entry of invoice information increases the turnaround time for processing to 7–14 days, whereas automated invoice capture reduces it to just 3–4 days [1]

- The average manual invoice processing cost is $15, whereas digital invoices cost $4.84 [2,3]

- Paper invoices increase the risk of errors and delay 55% of invoice payments, while scanning and data capture tools can achieve a 99% accuracy rating, leading to shorter payment times. [2,4]

The big question is how automated invoice scanning has achieved these results?

The answer lies in eliminating repetitive tasks, reducing approval cycles, significantly improving accuracy, real-time visibility of the AP process, and seamless integration with accounting systems.

In a highly evolved coup on manual processing, the invoice scanning solution has overthrown the paper invoice once and for all. The evolution of the AP process through optical character recognition and machine learning means that manual data will soon be unheard of in accounting practices.

That’s progress and will have the same impact as the telephone, the lightbulb, or the internet has had on the world.

The Real Business Impact of AP Scanning Solutions

Let’s get specific. Here’s how AP scanning solutions can add measurable value to all types of businesses, small or large.

1. Lower processing costs

The average cost to manually process an invoice can range from $12 to $30 (this depends on various factors like the number of invoices and the speed of the person processing them).

With invoice scanning and data automation, this cost is as little as $2 to $4 per invoice. For a business processing 1,000 invoices per month, an annual savings of over $100,000 (assuming a saving of $8 per invoice).

That’s just the labour cost, without calculating the opportunity cost of delayed payments, missed early payment discounts, and finance teams chasing down information and correcting errors. Every delay adds up and costs money.

2. Fewer errors and compliance risks

Incorrect payments, duplicate invoices, and late fees are a constant topic in AP meetings.

For some teams, correcting these money-draining mistakes seems like a never-ending struggle. There hasn’t been a good solution until now, when AP automation has made streamlining invoice processing possible.

Instead of trying to develop better processes, regulatory compliance is being achieved through the reduction of human error, and a second, technology-intelligent eye-ball on duplicate invoices, and transgression of internal procedures.

Ensuring accurate data capture is the number one priority when selecting invoice scanning software, and the companies that develop these platforms are in a race to outperform one another in this area. This is all to the advantage of AP departments.

3. Stronger vendor relationships

If you’ve ever been on the side that’s convinced better vendor relationships are directly linked to error-free invoice data capture and fast payments, then you weren’t wrong. When your vendors get paid on time – or better yet, early – it builds trust. It also builds your bank account as you benefit from early payment discounts.

This directly impacts the terms you receive, faster vendor service, and even preferential treatment – everyone loves a good payer. They also love customers who never lose invoices, the reduced frustration levels, and payment follow-ups.

4. Team efficiency and morale

This is perhaps not high on the list of priorities when choosing invoice scanning software, but it should be because the effort of manual invoice processing and chasing down approvals is demoralizing for AP staff.

The selling point for automation and greatly advanced AI has always been that it will allow humans to eliminate time-consuming tasks and focus on more meaningful work. This is no different with accounting automation.

Analyzing spend, managing vendor contracts, and working on cost-saving strategies is a much better use of human talents, with the potential to transform the AP process from a reactive function into a proactive, strategic one.

5. Scalability without hiring

One of the greatest benefits of electronic accounts payable processes guided by technology is the ability to scale without increasing the number of AP staff or the workload of existing team members.

Your current team will be able to handle the entire invoicing process, even if the volumes increase exponentially. By reducing manual data entry and moving the function of extracting key data over to automation (regardless of invoice formats), you can open your business up to increased opportunities, even taking on work outside of your own borders.

With invoice capture software, capacity issues are instantly resolved, and accounts payable teams are equipped to handle massive volumes of invoice, if necessary.

Envoice: A Smart, Scalable AP Scanning Solution

Envoice has become a go-to solution for businesses and accounting firms looking to modernize their AP processes without heavy IT investment. Here’s why Envoice is a good recommendation for venturing into automated invoice scanning.

Smart invoice capture

Envoice uses advanced OCR and machine learning to accurately capture invoice data from PDFs, scans, or email attachments. It even learns and improves as you go, reducing the need for manual correction.

Add ExactExtract (a human-in-the-loop verification feature), and you have a fully fledged invoice scanning software capable of accurately scanning invoice data.

This feature is ideal for businesses working with a wide range of suppliers – no need to rely on standardized formats.

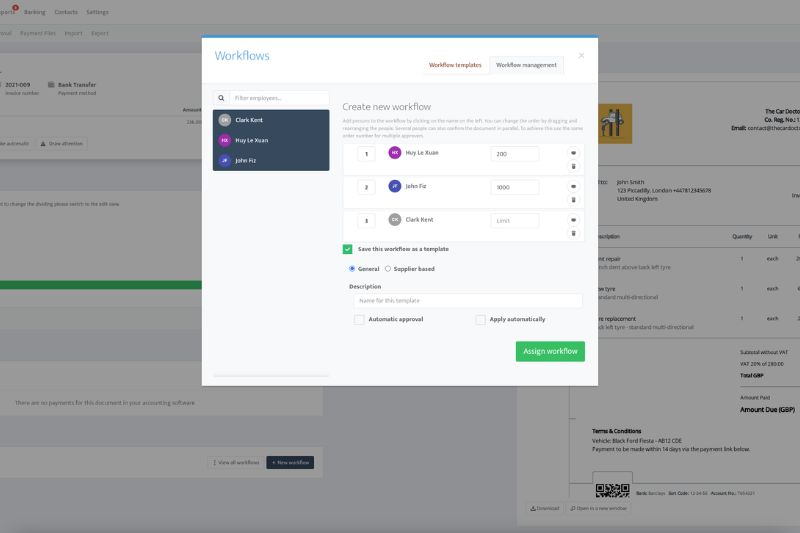

Seamless approval workflows

Envoice workflow approval

Invoices can be automatically routed for multi-level approval based on customizable rules. Increasing visibility and control over every approval step is key to efficient payables-management. Deploying advanced invoice approval software enables teams to flag exceptions early, enforce escalation paths and maintain full audit trails. This approach transforms invoice routing from a bottleneck into a strategic advantage.

Notifications, reminders, and mobile approvals ensure nothing falls through the cracks. Approvers can greenlight invoices on the go, eliminating bottlenecks and improving turnaround time.

The user interface is easy to navigate and acts intuitively, guiding you through the next steps in your AP process. As a technologically advanced invoice capture software, Envoice allows assigning different authority layers to your invoice approval.

This allows you to customize your entire process according to your internal processes.

Cloud-based collaboration

Perfect for remote teams, Envoice allows finance teams, managers, and vendors to interact with the same data in real-time, no endless email chain, which makes audit trails a nightmare. Just easy access to all your communication and documentation, securely stored in the cloud, accessible from anywhere.

Seamless integrations

The beauty of out-of-the-box integrations with systems like Xero, QuickBooks, Microsoft Dynamics 365, and ERPs is the elimination of double data entry. This alone can save up to 8 hours a week for bookkeepers or data capturers. [4]

When your most important systems are talking to one another perfectly, there are reduced errors, time-saving, and improved audits to look forward to.

Audit-ready and transparent

Every action is logged, and every change is tracked for internal compliance and audits.

You can easily pull reports, trace approvals, and respond to inquiries – no paper trails are needed. The biggest challenge businesses have in transitioning to paperless AP is the dependence on paper and the security it offers. However, with Envoice, you can confidently transition.

Use case: Accounting firm improves client service

When the Estonian accounting firm, Klaar.me, was searching for a full-fledged AP scanning solution, they looked no further than Envoice. Envoice was chosen as a partner to bring a completely paperless offering to Klaar.me’s over 200 clients across three continents.

Amongst the service providers that make the Klaar.me shortlist, Envoice made the most sense because it was highly adaptable to their clients’ needs.

The entire integration of Envoice with existing systems takes as little as 4 hours for smaller companies, and only a few working days for companies with multiple locations and subsidiaries.

In summary, Klaar.me thinks of Envoice as their accounting assistant, which is much quicker than a human.

Envoice Reviews

Envoice is by far the easiest and most economical way of introducing automated invoice scanning to your business, but don’t take our word for it. Here are the results of independent reviews taken from popular software testing sites.

G2: 4.2 out of 5

Capterra: 4.7 out of 5. Highly rated for ease of use and customer service.

Appsumo: 4.8 out of 5.

Final thoughts on AP scanning solutions

Accounts payable is no longer just about paying bills- it’s a key driver of efficiency and financial control. Just as we said at the start, AP scanning solutions aren’t just a tech upgrade- they’re a strategic move.

Tools like Envoice help you streamline invoice handling, reduce manual work, and gain real-time visibility into your payables. The result? Stronger vendor relationships, better cash flow, and more time for your team to focus on what really matters.

If you’re ready to modernize your AP process, now’s the time to act.

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day