Transforming 3-Way Matching in Accounts Payable

Your accounting and accounts payable department needs extra vigilance to keep fraudsters out.

As the departments in charge of handling payment approvals and disbursement, team members handling these functions should have adequate internal controls to verify the validity of a supplier invoice.

This is where the process called three-way matching comes in.

What is Three Way Matching?

A three-way matching process refers to the practice of comparing three primary documents to detect exceptions like errors, duplicates, or fraud. In a 3-way match, your Accounts Payable staff needs to check these documents:

Purchase Order

Also known by its acronym PO, the approved purchase order proves that the company authorized the purchase. Your PO should list the item, quantity, price, delivery date, and other information needed to fulfill the order. Purchase orders should have a unique number that companies can use for reference and monitoring.

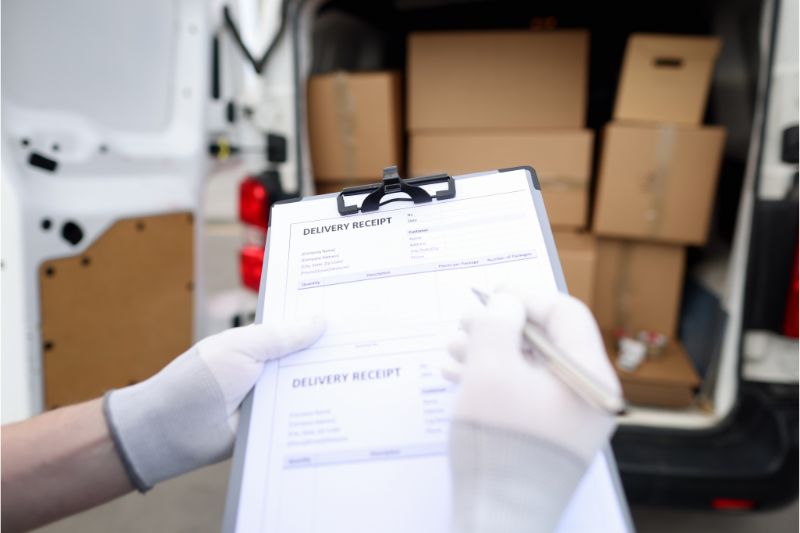

Goods Receipt Note or Delivery Receipt

AP teams also need to look for the delivery receipt or receiving report which serves as proof of partial or full delivery of a product. Your delivery receipt which should have a unique identifier should indicate the date of delivery, the person who received the order, and the quantity.

Supplier Invoice

Invoices refer to a document issued by your supplier to collect payment. Your supplier’s invoice should have a unique identifier. Payment details, including the quantity, amount, and payee show up on the invoice.

How to Perform a 3-Way Match

Doing a three-way match requires a purchase order, delivery receipt, and invoice. To perform these tasks, AP teams compare the items, quantity, and price indicated in these three documents.

Comparing the Purchase Order and Invoice

Companies often route purchase orders for approval based on the purchase requisition sent by the concerned department. As long as the invoice matches the purchase order, companies can expedite the invoice approval process since the PO has been pre-approved.

When performing a 3-way match, employees should look into the following:

- Reviewing the PO for completeness

- Vendor name and address

- Amount billed

- General ledger code

Validating Proof of Delivery

AP departments should match the PO against the delivery receipt. Checking with the receiving department or the person in charge of receiving items ensures that the company is not paying for a fictitious or duplicate item.

Cross-referencing Supplier Invoice Against Other Documents

Organizations have to check invoices against the PO to ensure that details match and only payments go out for authorized transactions. Cross-referencing invoices against the delivery receipt also makes it easier to verify if the company received all items indicated in the invoice.

Performing a 3-way match requires several steps as outlined above, so by default, companies perform a 2-way match.

Three-Way Vs. Two Way Matching

As the name implies, two-way matching only compares two documents – the purchase order and the invoice you receive from the vendor. Reviewers focus on comparing items, quantity, and price between these documents before releasing payment to the vendor.

Most companies have a standing rule to perform a 2-way match before paying an invoice. However, emerging threats make it safer for organizations to implement a three-way match that proves that actual delivery happened for items or services indicated in the invoice.

Before diving deeper into why 3-way matching works, let’s discuss why AP departments perform document matching.

What Could Go Wrong in AP?

Accounts payable departments face a variety of risks without proper controls. Here’s a list of things that could go wrong for your AP department.

Higher Fraud Risk

Fraud activity has been increasing in the previous years. In 2022, 65% of companies experienced attempted or actual payment fraud. [1]

The Better Business Bureau in the US warned companies about the increase in invoice fraud. Warnings of heightened fraud activity come in the wake of notable cases like a produce company losing about $5.8 million due to fictitious invoices [2]. Even corporate giants like Google and Facebook getting scammed into wiring about $100 million due to phishing.

Cases like this are common in the UK as well. In 2021, average losses from fraudulent invoices were about £14,000 – total losses reached £56.7 million. [3] The majority of the fraud victims were for business or non-personal accounts with high-value transactions that happen regularly.

Both scenarios highlight a similar trend – fraudsters are more likely to target businesses.

Schemes targeting organizations are also evolving. Business email compromise attacks often involve fraudsters who impersonate vendors or employees.

Losses Due to Duplicate Payments

Mistakes are common in AP – especially when your team deals with a high invoice volume. Human error may be unavoidable, but it can lead to significant losses. Duplicate payments are one of the most common problems in AP teams with poor internal control processes.

Organizations can end up paying vendors twice for the same purchase without proper checks and balances. Issues like this can be difficult to resolve since it’s time-consuming to solve. Having a three-way matching policy can reduce problems with duplicate payments since your AP staff can detect issues like two invoices linked to one PO and delivery receipt.

Increase in Errors

Errors like entering the wrong amount or forgetting to pay an invoice can cause problems for a business. Mistakes in invoice processing can have financial consequences, which may result in losses, but it doesn’t stop there. Taking too long to resolve problems can affect your relationships with your suppliers.

Penalties Due to Inaccurate Reporting

Since AP teams control expenses, issues with invoice amounts and recording may lead to overstatements or understatements that can affect the financial reports.

Several stakeholders rely on financial reports such as business owners, banks, lenders, government institutions, and other agencies. If these reports have inaccuracies, you may end up paying incorrect taxes and face penalties, especially if you are a publicly-traded company.

How Matching Works as an Internal Control

Without adequate controls, your organization can suffer from losses and potentially lose suppliers. Accounts payable invoice matching aims to identify irregularities to reduce losses due to error and fraud.

Matching is an effective way to determine if you received a legitimate invoice.

How Matching Expedites Invoice Processing

Aside from mitigating fraud, 3-way matching also results in these advantages:

Faster Invoice Payments

With a three-way matching practice, companies can speed up invoice processing. Once the organization receives the invoice from the supplier, approvers can expedite reviews if they have access to the PO and delivery receipt related to the invoice. As long as the quantity, price, and items match, approvers can make a decision and forward the invoice to the next department to start the payment process.

Makes Your Company Audit-Ready

Reviewing the invoice, PO, and delivery receipt to validate prices and quantities reduces potential issues that could come up during an audit. Auditors typically review these documents to make sure that the information is consistent. Fewer audit findings reduce stress and work for departments and business units involved. Companies can also avoid penalties if they have accurate and reliable information.

Strengthens Relationships with Suppliers

Paying on time is one way to boost your relationship with suppliers. Unfortunately, late payments continue to be a problem for many organizations. In 2021, about 50% of UK companies indicated that delayed payments hindered their growth.[4] More than half of small and medium businesses have concerns over the increasing volume of late payments.

By paying on time, you can build a better relationship with suppliers and this could help you save money in the long run. Improving vendor relationships could help you access better terms like a higher credit limit or more convenient payment terms.

Performing a 3-way match reduces late payments since AP teams can speed up decision-making when the invoice arrives. Unfortunately, this benefit can also be a problem when your organization performs the 3-way match manually.

Drawbacks in a 3-Way Match

A three-way match is more feasible when companies purchase items such as products. However, if your company pays for a service, matching is not always the best way to ensure delivery happens. Aside from service-related purchases, the biggest disadvantage in relying on a 3-way match happens when companies rely on a manual matching process.

Why Manual Invoice Matching Holds You Back

Too often, companies perform manual invoice matching to cross-reference information between these documents. Some of the biggest drawbacks in doing a 3-way match by relying on people include the following:

Labor-intensive Process

Since AP departments go through invoices one by one to verify charges sent by suppliers, invoice processes often take too long. Matching requires a lot of legwork – and your AP team could end up chasing after missing documents and exceptions rather than focusing on high-value work.

Documents could end up sitting on the approver’s table for days or even weeks and result in late payments, penalties, and even ill will for suppliers.

Handling High Volume Invoices Requires More People

Performing manual reviews requires a higher headcount if your department handles a lot of invoices. Adding more employees could mean higher labor costs.

Without adequate people, performing proper matching can be difficult. Invoice processing delays may also happen since your team can’t keep up with the growing number of invoices.

Friction Between Other Departments

When companies rely on a manual process, data often exists in silos. For instance, information available to your AP team may be different from the data available to another department. As a result, friction can happen within the organization. Your AP team may have to send multiple emails or make phone calls to verify the information they have.

Storing information digitally can fix this issue since scans of your documents – PO, delivery receipt, and invoice are in one location. Any changes should also appear in the central repository – so everyone can see modifications made to the documents.

Complexities May Arise

While a 3-way match is a simple process, complications may arise when you’re comparing documents. Resolving issues and cross-referencing other transactions that may be related to the existing problem can also be challenging since you are following a manual process.

Higher Room for Error

A manual AP process is prone to human error. Your team could make errors with data entry, misplaced documents, forget about a pending invoice, or misinterpret information. AP departments may also be subjective in applying thresholds for irregularities noted during the review. The lack of clear-cut rules makes it harder to catch fraud or errors.

Fraud Risks Remain

Relying on people to perform reviews makes fraud detection harder since parties involved may tamper with documents to avoid getting caught.

3-Way Matching Best Practices

While there are disadvantages to a three-way match, there are ways to mitigate these issues and make the matching process more efficient. here are some of them:

1. Determine a value threshold for invoices that require three-way matching. Applying a 3-way match is not always feasible or cost-effective. If you’re struggling with keeping up with invoices because of this requirement, decide on a value threshold and create a rule that all invoices over that amount need to undergo the 3-way-match process.

2. Decide on your tolerance level for exceptions. Invoices may include additional charges which may not be included in the PO or the delivery receipt. Minimal discrepancies don’t necessarily require additional review.

3. Automate AP processes. Introducing the right technology to reduce manual processes in your accounts payable department eliminates many problems in doing a 3-way match. Since your software compares information indicated on the PO and Delivery receipt, an automatic match for all invoices.

Ensuring Adequate Controls Without Holding Back Your AP Team

As threats evolve, so should your AP controls. Unfortunately, many companies struggle with maintaining the right balance between invoice processing speed and implementing sufficient controls.

Survey results from Ardent Partners found that 47% of organizations struggle with a lengthy invoice approval process – making it the biggest challenge for the accounts payable function.[5]

Upgrading your AP and payment processes is the key to paying suppliers faster while maintaining controls over invoice payments.

Automation reduces your reliance on manual controls and people – like reviewing all supporting documents to perform a 3-way match. As a result, your AP team spends more time on valuable work since they only have to perform a manual review when the automation software detects an exception.

With an automated expense management system, you can:

- Store all purchase orders and delivery receipts in one place

- Manage all information related to an invoice in a location accessible to approvers and reviewers

- Maintain an audit trail and track all actions related to an invoice approval request

- Allow your AP team to track the status of all invoices to avoid late payments.

Elevate AP Department Controls, Automate Today

Faster invoice processing and positive supplier interaction through faster 3-way matching is only one of the benefits of automation. Using intelligent platforms to manage expenses saves time and resources – creating significant value for your organization.

Automating simple processes like data capture from invoices and other documents puts the AP process on autopilot.

Take Envoice for a test ride and see how automation transforms how your accounts payable department works.

[1] JP Morgan

[2] United States Attorney’s Office

[3] National Federation of Self Employed & Small Businesses

STAY ALWAYS TUNED

Subscribe to newsletter

STAY ALWAYS TUNED

Still not sure?

- Don’t spend time on manual work

- Streamline processes with AI

- Automate your invoice flow

- Integrate with the tools you rely on every day