How to Organize Receipts for Small Business Using Automation

Produced by our content partners and reviewed by Envoice’s internal experts to ensure it reflects real accounting workflows and accurate product usage.

Imagine a scene in which a small business owner is poring over a pile of receipts that have been collected during the year. Frustration builds as the realization sets in that there has to be a better way of collecting, processing, storing, and approving business expenses.

Now imagine this same SBO a year later, after investing in the best accounting software for startups that automates the processing and approval of receipts and expense tracking. No piles of paperwork, no frustration, no missing documentation, no angry auditor. Just a sense of control over business receipts and finances. Bliss.

Join us as we show you how to go from receipt management chaos to total control with accounting automation software for small businesses.

Quick Overview

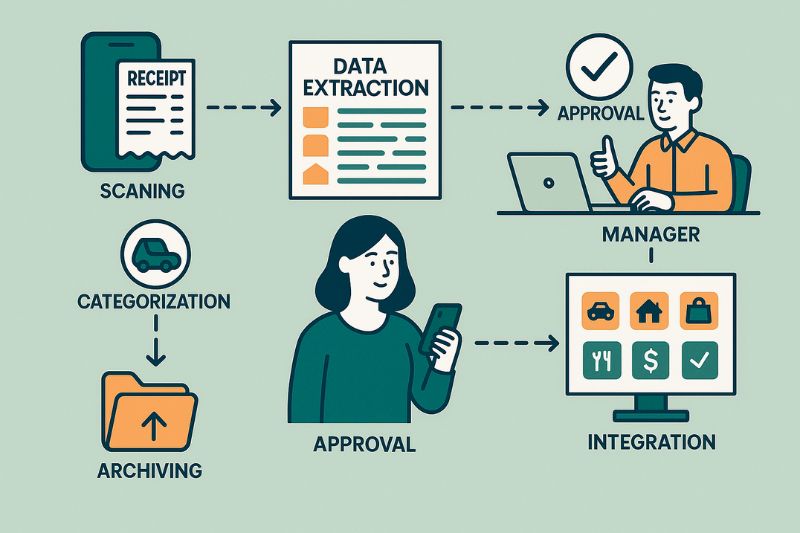

Automation helps small businesses organize receipts by scanning and extracting data, categorizing expenses, matching bank transactions, and securely storing records for quick approvals and audits. For expense reimbursements, it provides the ability to create expense reports that are sent for immediate approval and payment, helping small businesses manage their spending.

Table of Contents

- Why Automation Will Help You Organize Receipts in Your Business

- 6 Automation Features That Will Help You Organize Receipts

- Conclusion – Why Automation Is the Smart Choice for Small Businesses

Why automation will help you organize receipts in your business

Business expense receipts come at you from all angles, and if you don’t deal with these receipts immediately, the task can get away from you. The main issue is that it takes time to process receipts manually – more time than you have on your hands. So what’s the answer?

Automation software helps you organize business receipts by instantly capturing information and categorizing it into the correct expense account. Once receipts are processed, they can be matched to the business credit card by the software and finalized. In summary, you are no longer loading paper receipts into an Excel spreadsheet and manually tracking expenses.

The benefits of automated receipt management are:

- Speed: Transactions are processed within minutes of being scanned or received via email. Next, they’re categorized according to your chart of accounts, cutting down processing time.

- Accuracy: The risk of errors is reduced as custom rules and approvals drive the correct categorization of receipts for business purposes, while personal expenses are flagged and sent to review. This also increases compliance for tax purposes.

- Collaboration: Financial records can be shared in real-time, giving access to reviewers, approvers, and accountants. This prevents a backlog in organizing your receipts. When information is processed speedily, it leads to accurate financial records.

- Scalability: The process will work whether you have fifty receipts or five hundred. The volume of receipts will make no difference to the effectiveness of the process.

Learn about how automation has been helping other companies to do things faster, and save time and money 👉 AP Automation & Machine Learning: Finance Game Changers provides an in-depth look at automation in action.

If you haven’t yet adopted AI bookkeeping into your business, you may also enjoy: AI Bookkeeping For Small Business

6 Automation features will help you organize receipts

A number of built-in automation features have been designed to help small businesses keep business receipts and manage expenses in an organized and efficient way.

1. Digital receipt organization with OCR and machine learning technology

With a manual filing system, someone has to take ownership of collecting receipts for processing.

This is commonly done by placing the receipts in a physical file or doing it electronically by creating an email folder for receipts. While keeping physical receipts organized and safe is one thing, manually processing them is another, and the time it takes to do this can cause receipts to pile up.

Automation software takes all the work out of this initial attempt to organize receipts. By scanning receipts as soon as they are received and extracting information from them simultaneously, the software can effectively capture the expense within minutes. You can learn four methods for scanning receipts here 👉 How To Scan Receipts: 4 Quick and Easy Methods.

As you refine this process, the same technology can be applied beyond receipts to invoices from suppliers. An approach based on ai invoice processing uses similar data extraction and validation tools to keep your accounts payable records as clean and organized as your expense documentation. That way, you build one consistent, automated workflow from incoming receipt through to final invoice posting.

For a powerful pre-accounting software with intelligent receipt capture, consider an add-on like Envoice. Our AI-powered solution is sophisticated and highly accurate at recognizing information from all types of receipts. Sign up today to benefit from advanced extraction technology.

2. Instant categorization according to custom rules

Once data is extracted, categorization is done according to custom rules, and the technology keeps learning new information about how you like your receipts handled, the more you scan and categorize receipts. The end result is that you only need to review the information captured and approve it with one click. Everything else has been handled by the software. With the right software, up to 8 hours of processing time can be saved a week. [1]

This important benefit of automation also has positive implications for tax deductions. Most accounting software will set up rules according to your country’s tax regulations for business deductions, and suggest appropriate expense categories. This helps small businesses claim the correct deductions.

3. Cloud storage to store receipts safely

While manual files have previously been the benchmark for storing receipts, this method is no longer the best option. Automation accounting software provides a secure way for all your receipts, invoices, and other financial documentation to be stored in one place. Even if you currently use digital storage such as OneDrive, Dropbox, or Google Drive, you can connect these platforms to the accounting software and create a seamless way to keep digital copies.

You don’t need to upload documents, store them in the right folders, and remember to consistently name the documents, either. The software will do this for you, keeping everything neat and organized.

4. Bank statement reconciliation

The reconciliation of the business credit card statements, the bank account, and small business receipts is a critical aspect of finalizing expenses. Traditionally, this would require checking the bank statements line by line against receipts, making sure all transactions are accounted for. This process can be extremely time-consuming, and the risk of missing transactions is high.

Fortunately, this process has been shortened drastically with the use of automation software as follows:

- The software pulls information from the business bank account you have connected.

- It matches records of scanned receipts with transactions on the bank statement.

- The software then notifies you that there are transactions that require review and approval.

- Once you have reviewed the transactions, they are pulled through to your financial records, updating your expense categories with the new totals.

4. Customized approval workflows

One of the biggest advantages of automation is the ability to route receipts and expenses through a digital approval process that matches your company’s policies. Instead of chasing down manual approvals, you can create custom rules in the software that direct it to:

- Automatically forward transactions for approval if they meet certain criteria.

- Escalate transactions over a certain limit to a manager or senior approver.

- Flag transactions that are duplicates or suspicious (i.e., not the norm for certain expenses).

The entire approval process is timestamped to ensure an accurate audit trail and increase the transparency of internal processes.

5. Mobile expense management

A game-changer for small businesses that need on-the-go expense management is the ability to instantly handle receipts via a mobile app that syncs to the automation software. This enables employees who make minor purchases (such as office supplies) or travel for business to be reimbursed quickly. The process works as follows:

- Employees snap a picture of their receipt using their smartphone and a mobile app.

- OCR technology extracts information line by line and categorizes the expense.

- The expense is sent for review for electronic approval.

- Once approved, the expense is forwarded for reimbursement.

- The expense appears immediately in the correct expense category in your financial reports.

Employees remain focused on their jobs, and you remain completely in control over your expense policy.

Curious about how this can work in your business? Try Envoice on a free trial for 14 days. The platform’s standout features include superior extraction technology, customizable workflow approvals, and a powerful expense management function.

6. Archiving for audit trails

Accounting regulations require business owners to keep a record of financial documentation for 3-5 years. According to the Internal Revenue Service (IRS), you need to keep documents for a period of three years for tax assessment purposes. With automation, this is the final step in organizing your receipts. With automation:

- Every receipt is kept in secure documentation archive servers.

- Metadata such as upload date, approval status, and payment dates are automatically logged.

- Archived documents can be retrieved with the software’s advanced search function.

- Audit trail reports can be produced within minutes, which saves you the panic of scrambling around for paper receipts at audit time.

Further reading related to receipt organization: How to Organize Business Receipts for Your Small Business: 8 Easy Methods

Conclusion

Automation is a game-changer for small businesses battling to organize receipts, moving from a tedious, chaotic process to a structured, fast, and fully compliant process. Instead of chasing paper receipts, manual processing, and bank reconciliations that can take days, you can let the software do all the hard work, while you take complete financial oversight back over your business.

Organizing receipts and expense management no longer needs to be a long, frustrating, and inefficient process. You can enter the era of smooth-flowing workflows, instant approvals, and real-time financial reports any time you’re ready. Get ready now for the next tax season. Why wait?

Are you ready to take total control over receipt management?

👉Try Envoice for 14 days on a free trial and discover the big impact automation can make. From instant data extraction to archiving, Envoice takes care of the entire receipt organization function, freeing you up for other important business activities.

Frequently Asked Questions

1. Can automation tools handle receipts in different formats?

Yes, whether it’s a photo, scanned PDF, or emailed invoice, most platforms can capture and process multiple file types.

2. Will I need to keep paper copies after scanning receipts?

This is dependent on your country’s tax laws. Many countries make allowance for digital receipts as long as they are clear, accurate, unaltered, and securely stored.

3. Is automation cost-effective for a micro-enterprise?

Absolutely. Tools that help you organize your receipts digitally and store them securely are a cost-effective option for even the smallest business. Subscriptions vary between providers, but there are many options to choose from, giving you the freedom to enter this market.

4. What are the rules for receipts according to the IRS?

According to the IRS recordkeeping rules, receipts are compliant when they have the vendor’s details, date, total paid, and a description of the goods purchased.

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day